The Federal Reserve sparked a huge rally in precious metals markets on Wednesday when it forecast super-low interest rates for the next three years and hinted at more money printing to come; the gold price surged more than $50 an ounce within about an hour and silver jumping almost $2 an ounce.

The yellow metal is now off to its best start to a year since 1980 when prices rose nearly 70 percent over a period of three weeks to the inflation adjusted record high of $850 an ounce.

For the week, the gold price rose 4.2 percent, from $1,667.00 an ounce to $1,737.30, as spot silver followed up weekly gains of 3.2 percent, 3.5 percent, and 8.2 percent so far this year with an impressive surge of 5.6 percent last week, from $32.20 an ounce to $33.99.

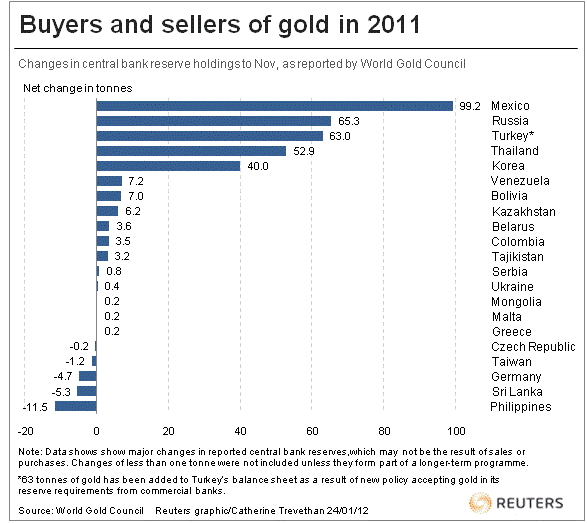

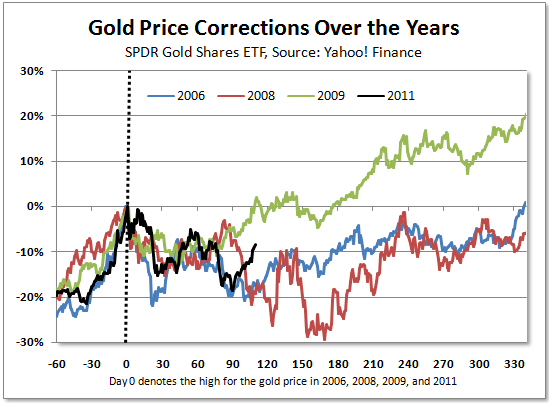

The gold price has now risen 10.9 percent for the year, down just 9.7 percent from its 2011 high, while the silver price is up 22.0 percent in 2012, but remains 31.3 percent below its high last spring. It’s been a remarkable start for 2012 after a disappointing December and this Reuters graphic on central bank gold purchases last year adds to the case for strong metal demand that is not going to go away anytime soon.

click to enlarge

All told, central banks are expected to have purchased a record 450 tonnes of gold in 2011, ironically, about the same amount that European banks used to sell each year before those sales abruptly stopped shortly after the 2008 financial crisis

Note that it is emerging market economies that are adding to their gold reserves, one of their primary motives being to diversify away from large concentrations of U.S. dollar holdings for reasons made clear in comments by Fed Chairman Bernanke last week that, in effect, signaled years of “financial repression” aimed, in part, at liquidating the massive U.S. debt.

Not all analysts are expecting further gains for gold, however, as CPM Group said last week that the rally is likely to be short-lived since it has been driven by short-covering in recent weeks and that gold and silver coin and bar premiums continue to decline.

They went on to note that last week’s Fed policy move:

… did not point toward any development not already largely expected by the market, therefore the temporary increase in asset prices resulting from yesterday’s meeting is not expected to provide a medium- to longer term springboard for prices.

A Q1 2012 Metals Review by Natixis Commodity Markets was also quite bearish, the group saying that gold prices could average $1,450 an ounce this year with the silver price falling from an average of $26 an ounce in 2012 to just $18 an ounce in 2013, both metals failing to attract investment demand after the heightened volatility of 2011.

But, many analysts remain bullish on precious metals, a recent survey by Reuters indicating an average spot price of $1,765 this year, up 14 percent from 2011.

Barclays Capital said last week they remain neutral about gold over the short-term citing cautious investor demand, but that physical demand in Asia has been resilient and the group predicted that a $2,000+ gold price will be seen by the third quarter of this year. Interestingly, they see a similar surge for the silver price through the summer but forecast year-over-year price declines late in the year.

The Outlook for 2012

It’s a bit odd to think back to a month ago when most others were writing about what they expected in the New Year, that is, when the gold price was in the mid-$1,500s and silver looked like it might be headed back to the low $20s.

As the natural resource sector is about to wind up a stellar month of January, it’s a decidedly different base from which projections for the New Year can be made, though, I don’t think recently rising prices have made a substantive difference in what I’d write then vs. now.

For most of the last ten years, I’ve thought the gold price would end the year 10-20 percent higher and that silver could make an even bigger move (though, with much more downside risk) and that’s turned out to be a pretty reliable trend.

My thoughts are no different this year, however, one important distinction for 2012 is that I have gone on record saying the gold price will top the $2,000 mark at some point – a gain of nearly 28 percent from 2011 year-end – and I stand by that prediction.

It won’t necessarily end the year over $2,000 an ounce, but I think we’ll hit that mark.

The one-two punch of surging Chinese demand and a more dovish Fed have driven prices through important technical levels in recent weeks and, while a setback in the European sovereign debt crisis could cause the rally to stall, it should only be temporary.

One of the most interesting aspects of the 2012 surge has been how the mainstream financial media has reacted after all but declaring the gold bull market dead in December – they’ve been quiet. By and large, this group still hates the idea of gold and silver as an investment and, to me, this is one of the best indications that the bull market still has a long way to go and that much higher prices could be in store this year.

As I’ve said many times over the years, when Money Magazine gets fully on board with a 10 to 25 percent recommended asset allocation for gold, that’s when I’ll start thinking about selling, and I expect that time to come at much higher prices.

Asia: Where They Love the Yellow Metal

Year-end commentary in the U.S. as metal prices plunged were a real sight to see. After watching over the last two-and-a-half years as the gold price proved indefatigable, barely experiencing a 10 percent correction during that time, the mainstream financial media pounced on the December swoon, particularly after the supposed “death knell” of breaching the 200-day moving average. Here’s some commentary from mid-December to mid-January that I tucked away for this occasion:

- Dec. 15 – WSJ MarketBeat Blog – Sorry Goldbugs, You’re Losing to Treasurys in 2011

- Dec. 29 – WSJ MarketBeat Blog – Sorry Goldbugs, You’re Only Even With the Dow ’11

- Jan. 9 – WSJ – Exchange-Traded Funds: Is the Golden Age Ending?

- Jan. 13 – MarketWatch – Why gold could lose its glitter in 2012

And these are from publications that I generally consider to be even handed toward precious metals – the Wall Street Journal and MarketWatch.

I’m sure there were many more articles in many more financial publications that expressed a good deal of glee that the gold bull market was finally over and that investment advisers would finally stop being asked uncomfortable questions about the role precious metals should play in their clients’ investment portfolios.

Perhaps the best example of how little has changed in how U.S. investors think about gold came in the wildly popular article here at Seeking Alpha three weeks ago Why, At 28, I’m Going With Dividends. This prompted nearly 250 comments and once again strengthened my belief that U.S. investors are so fixated on equities – “Which companies are looking good? Which ones are you buying? Have you checked out this one?” – that they’ll be the last to the party when it comes to gold, most of them getting in too late and, like the internet and housing bubbles, signaling the end and being saddled with losses.

Again, ask your neighbors and other acquaintances what they think of gold as an investment and you’re likely to hear little dot.com or housing bubble enthusiasm and this means we’re still a long way from the top because, inevitably, the world’s largest pool of investors will not be able to stay away from this market when it really takes on bubble proportions.

But I wouldn’t be surprised to see a full-blown gold-mania develop in China and India this year as it’s been bubbling close to the surface for months now. With a long cultural affinity toward precious metals and living in a very different economic environment – an upwardly mobile society with limited investment options and much higher inflation – you might just see Asia drive gold and silver prices to unthinkable highs as soon as this year.

But I wouldn’t be surprised to see a full-blown gold-mania develop in China and India this year as it’s been bubbling close to the surface for months now. With a long cultural affinity toward precious metals and living in a very different economic environment – an upwardly mobile society with limited investment options and much higher inflation – you might just see Asia drive gold and silver prices to unthinkable highs as soon as this year.

I’m not counting on that developing and, as always, would be happy with a tamer 10 to 20 percent gain, but, given the November gold import data that from China as discussed here two weeks ago, that’s a real possibility.

The Chinese people and the Chinese central bank will continue to play a huge role in determining the trajectory of gold and silver prices and the recent shift from fighting inflation to spurring growth is profound. A “hard-landing” is still possible, but my guess is that they’ll muddle through somehow, likely concealing how much home prices are falling in the official data and even encouraging a “gold bubble” to help offset the impact of lower property values.

Investment demand in China has surged and they just surpassed India as the world’s largest consumer of gold jewelry, however, India is still a major source of demand and they seem to be overcoming the recent doubling of the gold import duty that had some analysts concerned about denting demand. Wedding season buying was reported to be up last week despite dealers passing on these higher costs to their customers.

Ironically, when the gold price plunged in December and writers in the U.S. were penning obituaries for the gold bull market, it turns out that people in China and India were buying the metal hand-over fist at reduced prices. That much seems clear at the moment and this bodes well for the year ahead.

What we saw in recent months was a long overdue major correction for metal prices – nothing more – and the Fed’s low interest rate promise may just compel more Americans to buy some of the metal now that they know they aren’t likely to get more than a half percent on their savings accounts until 2015.

As long-time reader “DLP” commented at the blog the other day in reaction to “More on Bernanke’s War Against Savers“:

This might just be the thing that really kicks the U.S. gold boom off.

Ten million people buying an ounce or two of gold because they think they might be better off putting that money into gold coins than in a bank – that’s like 500 tonnes of gold.