Before I say some negative things about silver (SLV), let me first say that now is likely a great buying opportunity. In addition to the main theme that has been driving silver for the past 11 years — a global sovereign debt crisis leading to demand for precious metals as monetary assets, as well as increasing industrial demand for silver and declining silver reserves that are easily extracted in the earth’s crust — are the short-term technical factors. Specifically, they are:

- We’ve had two big pullbacks within the past 12 months, increasing the likelihood that bears have been exhausted out of the market.

- Silver has spent the last 11 trading days consolidating above the 200-day exponential moving average, suggesting it has found its bottoming support and is ready to rally.

- Once 35.50 is breached, there are few resistance levels on the way to $44. So, the stage is being set for momentum to gather and for a rapid re-test of previous all-time highs near $50.

I think there are a number of highly favorable risk/reward setups here for those proficient in technical analysis. The chart below illustrates the basic story.

(Click chart to expand)

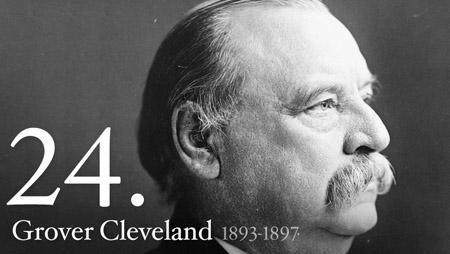

However, for those with a longer-term mentality, it’s worth thinking about the difference between gold and silver. And to best understand that difference, it’s worth remembering former U.S. President Grover Cleveland.

Known largely for the distinction of being the only U.S. president to serve two non-consecutive terms, Cleveland actually has a distinction that makes him far more significant to U.S. monetary history and to our current times: his battle with the silver industry during his second term.

When Cleveland returned to office in 1893, the U.S. was on the brink of a currency crisis. The Sherman Silver Act, passed in 1890, basically served to re-monetize silver and increase the money supply accordingly. Rich people with savings saw this as a problem, as it was basically the age-old story of inflation of the money supply deteriorating the value of savings; the poor and working class loved this idea because it gave them cheap and easy money, at least on an immediate basis.

The Sherman Silver Act eventually led to the Panic of 1893, illustrating one of many examples in history of how inflation of the money supply results in greater market volatility — often through the creation of asset bubbles followed by a panic exodus. The Panic of 1893 was also preceded by a severe and global deflation, which also serves as an illustration of how severe deflation can lead to banking crises, a loss of faith in the currency, and the onset of hyperinflation via a panic out of the currency itself. When one considers our current situation, it is clear that history does seem to repeat.

To stabilize the currency and prevent even greater problems, Cleveland had to squash the efforts to monetize silver. Savings needed to be preserved and prices denominated in gold needed to come down. Malinvestments would be liquidated, lower savings would encourage consumption and investment, and the economy would be healed.

This story illustrates the big difference between gold and silver: when it comes to which one will officially be re-monetized, either by nation states, supranational government, and/or non-state networks like activist groups, the odds are much greater that gold will be re-monetized instead of silver. And to the extent that gold and silver compete for the crown of true money, gold will likely win, as it has greater commitment from wealthier individuals and thus more capital ultimately behind it.

So what’s this mean? Well, the simple implication is that silver has less buy and hold value than gold (GLD) does. With that said, as we have already seen, it has enormous volatility and thus significant upside potential — if not for its monetary demand then for its industrial usage. But when I think about Grover Cleveland, I have to question how strong the relationship between gold and silver really is, and if the 16:1 historical gold/silver ratio frequently touted by silver supporters will come to pass on a sustainable basis.

Bottom line: if you’re playing silver, enjoy the ride. I do believe it will meet and exceed its previous all-time highs, and consider a move past $100 to be probable. Just don’t forget to get off before the smackdown comes, either from monetary authorities of governments or from those more committed to gold who do not want to see their turf being encroached upon.