Silver is especially attractive because it functions as a precious metal in that maintains its value over long periods of time. Yet it is also an industrial metal that is consumed, and demand for silver by producers of computers, mobile devices, photovoltaic cells, and water purification systems is rising rapidly.

In this article I detail the reasons for which I am bullish on the price of silver. First, silver is inexpensive relative to gold. If one is bullish on the price of gold, and if silver is inexpensive relative to gold, then silver is good value a fortiori.

Second, the trend in industrial demand for silver is positive. Silver is used in industries that are generally growing. Additionally the number of products in which silver is found is generally increasing. As a consequence, the uptrend in industrial demand for silver is a secular trend that is outpacing the rate of growth of the global economy, thus making it resistant to global recessions.

1. Silver is Inexpensive Relative to Gold

Currently it takes approximately 55 ounces of silver to buy an ounce of gold. By all significant metrics the gold/silver ratio should be significantly lower than this.

Annual Mine Production: In 2011 silver production stood at approximately 761 million ounces, according to the Silver Institute. 2011 gold production was approximately 78 million ounces according to the U. S. Geological Survey. Thus silver production was approximately 9.8 times greater than gold production.

Total Reserves: The word “reserves” is an accounting term used by mining companies. An ounce of metal counted in “reserves” has a high probability of being mined: not only is the mining company highly certain of its existence, but the metal is also profitable to mine given current economic conditions. According to USDebtClock.org, global gold reserves stand at approximately 1.78 billion oz., while silver reserves are 18.57 billion oz. Thus silver reserves are approximately 10.4 times greater than gold reserves.

Above Ground Inventories: Above ground inventories of gold and silver are impossible to measure, as nobody knows how much gold and silver resides in safes, under mattresses, under floor boards…etc. But, for the purpose of establishing that silver represents better value than gold, a rough estimate based upon government and warehouse holdings may prove to be sufficient, provided that it demonstrates a large enough disparity between the gold/silver inventory ratio and the current gold/silver price ratio that even a large error would not impact the conclusion drawn from it.

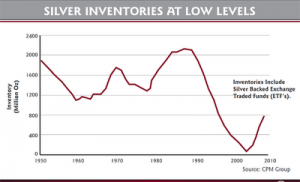

According to this chart from CPM Group, silver inventories including SLV holdings were just under 800 million ounces in 2010.

This is less than the gold holdings of the top 10 gold holding nations (including the IMF), according to the current data from USDebtClock.org. Thus if CPM data is accurate, it is conceivable that above ground silver inventories are actually smaller than the above ground gold inventories.

One can also intuit a bullish inventory situation given: (1) the above mine supply data and reserve data that suggest a silver/gold occurrence ratio of about 10 to 1, and (2) the fact that more than half of the mine supply of silver is used for industrial production, whereas an insignificant amount of gold supply is used for industrial production. One can make a rough estimate from these facts that the above ground inventory of silver is significantly less than 10 times that of gold, and probably less than 5 times that of gold.

While these conclusions come from rough estimates that likely contain errors, all that is needed to be established regarding above ground inventories is that silver represents good value at 1/55th of the price of gold.

2. Industrial Demand for Silver

The industrial demand for silver is in a secular uptrend. What I mean by this specifically is that the industrial demand for silver is generally growing at a significantly faster rate than the global economy, and consequently the silver used in industry continues to make up a larger part of the entire global economy.

According to the Silver Institute industrial demand for silver in 2002 was 355.3 million troy ounces. In 2011 (2012 data is not yet available) this rose to 486.5 million ounces. This averages out to a 3.2% annualized rate of increase.

Furthermore, the average price of silver in 2002 was about $4.75 per ounce (my estimate), while in 2011 the average price was roughly $34 per ounce (my estimate). Over this 10 year period the total industrial demand for silver rose from $1,687.7 million to $16,541 million. Thus the compounded annual growth rate of industrial demand for silver in dollar terms has been 26.4%. During the same time period global GDP rose from $33.4 trillion to 70 trillion, reflecting a CAGR of 7.68%. Consequently, the industrial demand for silver is generally rising at a much faster rate than the global economy.

There are two primary reasons for this. First, silver has unique physical properties. Silver is the best reflector of light, the best conductor of heat, and the best conductor of electricity of any regularly occurring element on Earth. Consequently silver is an essential resource for producing both electronic devices and insulating products. Silver also has anti-bacterial properties and as a result you can find trace amounts in products such as bandages and underwear. I will discuss some of the specific industrial applications of silver after I give the second reason for the rise in industrial silver demand.

Second, the industrial demand for silver is generally inelastic. Inelastic demand means that large price swings do not markedly impact the demand for the product in question. For example, an iPhone that might retail for $500 contains a small fraction of a gram of silver worth less than a dime. Supposing for the sake of simplicity, that it contained exactly 10 cents worth of silver, were the price of silver to rise 20 fold to just under $600/ounce, the added cost to Apple (AAPL) would be a mere $1.90 on a product they are selling for over 200 times that amount. Apple can easily absorb that cost or pass it on to its customers, all of whom would buy the iPhone for $501.90 if they would be willing to buy it for $500. The opposite of inelastic demand is elastic demand, which is exemplified by gasoline. If gasoline prices were to rise 20 fold to $80/gallon at the pump people would use far less of it.

The industrial demand for silver is inelastic because, as in the case of iPhones, manufacturers generally use a very small amount of it in each product they produce. Thus, even if the price of silver rises exponentially, as I expect it will, manufacturers will not see their input costs rise significantly as a result.

The demand picture I give here is extremely bullish for silver prices. While industrial demand for silver is growing at CAGR of 3.2%, mine supply during the same time period only increased from 594.5 million ounces to 761.1 million ounces, or at a CAGR of only 2.5%.

2A–Industrial Demand for Silver in Specific Industries

Solar Energy

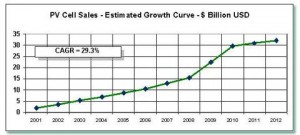

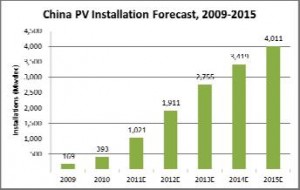

Solar energy is not yet economical relative to more conventional energy sources, however governments throughout the world are subsidizing solar energy in order to become energy independent and reduce pollution. Consequently the production of solar panels has been skyrocketing.

While commodification of photovoltaic cells has led to a decrease in the CAGR in the solar industry, the government subsidies to the solar industry, particularly in China, ensure that there is still long-term growth in the industry.

I should note that without these subsidies the use of silver in photovoltaic cells is an exception to the aforementioned inelasticity of silver’s industrial demand.

Mobile Devices

Mobile devices, particularly smart phones, are becoming ubiquitous throughout the world. The chart below shows enormous growth in the number of units sold globally on an annual basis. While the market appears to be reaching saturation, consumers constantly replace their mobile devices as technology improves and prices come down. Even if the growth rate slows, silver demand for producers of mobile devices is inelastic, and it should remain robust.

Batteries

Silver is replacing lithium in batteries, especially those used in computers, mobile devices and other electronics. There are two reasons for this. First, silver batteries last longer than lithium batteries. Second, lithium batteries are thought to be worse for the environment than silver batteries.

Water Purification

Silver ions are replacing chlorine in water purifiers. Both silver and chlorine have antibacterial properties. However silver is less toxic for humans to consume. Given that water purification is an immediate concern in developing economies, particularly in Africa, water purification is an industry that should support the long-term growth in industrial silver demand.

Other Sources of Silver Demand

Jewelry and Silverware

Demand for silver jewelry has not changed significantly in terms of the amount of physical silver, but the rise in price means that demand has increased for these items in terms of dollars. I don’t expect any material changes to demand for jewelry and it is possible that as the price of silver rises substantially that people will sell their items if they are in need of cash.

Demand for silverware has been declining in terms of the amount of physical silver, although it has been rising in terms of dollars. Regardless, silverware makes up less than 5% of total silver demand and consequently it can be ignored in the context of the larger silver demand picture.

Photography

Demand for silver in photography has been steadily declining as digital photography replaces traditional photography. This has dampened overall silver demand over the past decade as photography-based demand used to be one of the largest sources of overall silver demand. Yet the impact of this secular decline has diminished, as it is now less than 10% of annual mine supply (See data from the Silver Institute). The secular uptrend in industrial demand will end up dwarfing this decline to a greater and greater extent over time, and as a silver investor I am not at all concerned about silver demand in photography.

Silver represents excellent value at current prices.

Given that industrial demand for silver is growing rapidly, and given that above ground silver inventories are largely unknown, a much lower gold/silver ratio is within the realm of possibility.

Thus, while silver is not a stable asset to the extent that gold is, it should constitute a significant amount of any portfolio along with gold.

Silver is conventionally viewed as a “riskier” asset than gold. However given that silver represents better value than gold, I would argue to the contrary. The perceived added risk in silver relative to gold is due to the fact that the price of silver is generally more volatile than the price of gold.