In my previous post, I recommended buying gold. On that occasion, I explained that one main reason for expecting a long term rise in the price of gold is the behavior of the Central Banks. Ever since 2010 the Central Banks have become net buyers of gold after many years of only net selling. On February 14, 2013, the World Gold Council published its report, Gold Demand Trends Q4 and Full Year 2012, where it was clearly expressed that this trend is continuing. According to the report:

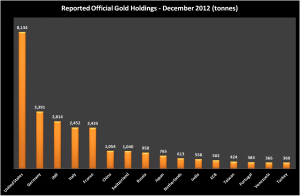

The list of countries actively adding to their official gold holdings remains heavily concentrated in developing markets, which partly reflects the scale of growth in the reserves of these markets over recent years. As the official reserves of these countries swell, with their heavy emphasis on US$- and euro-denominated assets, the need to diversification also increases. With a focus on high quality, liquid assets as desirable alternatives, gold is a natural destination for a proportion of these increased reserves.

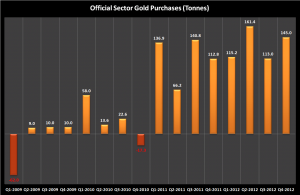

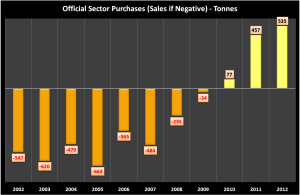

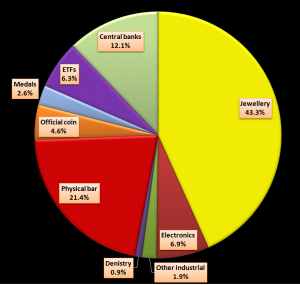

According to World Gold Council, in the fourth quarter of 2012, central banks continued to purchase gold at an increasing pace. Central banks’ net demand in the quarter was 145 tonnes (4.66 million ounces) worth $8.03 billion, accounted for 12.12% of overall gold demand during the period. In the third quarter of 2012, central banks purchased 113 tonnes (3.63 million ounces), which accounted for 10.2% of overall gold demand during the period. Total net purchases by central banks in 2012 was 534.6 tonnes (17.19 million ounces) worth $28.68 billion, accounted for 12.13% of overall gold demand during the period. Total net purchases by central banks in 2012 exceeded 2011′s already strong total by 17% and signaled a return to levels of buying last seen almost 50 years ago.

According to the World Gold Council, since first becoming a net purchaser in Q2 2009, central banks have added almost 1,100 tonnes to global gold reserves, almost reversing the 1,143 tonnes net sales conducted over the preceding three years.

Among the main central banks that purchased gold in 2012; Russia bought 75 tonnes, Brazil 34, The Philippines 33.6, South Korea 30, Iraq 24.1, Mexico 19 and Paraguay bought 7.5 tonnes.

The total demand for gold in 2012 was 4,405.5 tonnes (141.64 million ounces), worth $236.4 billion. Demand was down 3.9% from the previous year. The demand for gold for jewellery declined 3.2% in 2012 to 1,908.1 tonnes (61.35 million ounces) from 1,972.1 tonnes (63.40 million ounces) in 2011, and the demand for investments, bar, coin, medal and ETF, declined 9.8% in 2012 to 1,534.6 tonnes (49.34 million ounces) from 1,700.4 tonnes (54.67 million ounces) in 2011.

Gold Demand In 2012

Here are some important ETFS for gold which are traded on NYSEArca:

SPDR Gold Shares (GLD), Sprott Physical Gold Trust ETV (PHYS), ETFS Physical Swiss Gold Shares (SGOL), ETFS Physical Asian Gold Shares (AGOL), iShares Gold Trust (IAU) and PowerShares DB Gold (DGL).

The table below presents the trailing total returns of holding these funds; year to date (February 16), one year, three years and five years. The returns for the three and five years are annualized.

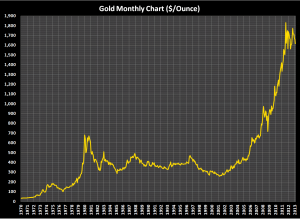

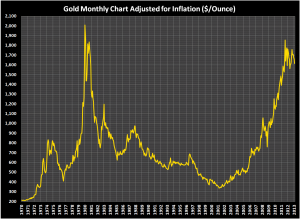

The table clearly shows that during the last year gold was a poor investment, but holding the funds for the last three years has given a very nice average annual return of about 13%, and for the last five years has given a very nice average annual return of almost 12%. In my opinion, the last decline in the price of gold, as shown in the charts below, is a good starting point to invest in gold.

Summary

The fact that so many central banks are increasing their gold holdings shows that they believe that considering its actual price, gold is a good investment, which will preserve its value. Central banks are aware of the fact that demand for gold will remain strong. They also realize that because un-mined known gold reserves are only 51,000 metric tonnes, when the global annual gold demand is about 4,500 tonnes, discovering and developing new reserves will turn out more costly.

In my opinion, central banks’ increasing purchasing trend is a long term trend and will drive gold prices higher. Since central banks were responsible for 12% of the total global gold demand in 2012 and are continuing their gold purchases, there is a high probability that gold price will rise during the next years, and that will give investors an opportunity to join the trend and make nice profits.

In addition to central banks which are increasing their net gold purchasing, also investors who are looking for a safe haven in this environment of uncertainty in the global financial markets will increase their investment in gold, and I believe that the last decline in the price of gold is a buy opportunity.