The difficulty in valuing gold (GLD) lies in the fact that it’s an asset that is never expected to generate any cash flow. Valuing such an asset is a fundamentally different concept to that of valuing bonds or stocks. Even growth stocks are in theory eventually expected to pay the investor something. These future expected cash flows discounted back to today determine what the stock should be worth today. The difficulty of making such estimate aside, no one would ever buy a stock or a bond that is never expected to return anything.

The usual asset classification of gold is as a commodity. The problem with this classification is that gold does not get “consumed” in the usual way that commodities do. While oil (USO) gets burned to generate energy, copper (JJC) is used to conduct electricity, and food (DBA) fuels our bodies, gold’s value is only loosely related to its uses in jewelry and electronics. The primary use of gold is the preservation of purchasing power and exchange medium. These characteristics make it closer in nature to currencies than to commodities.

In fact the best way to think about gold price is to think in terms of exchange rates with gold being just another currency. The “Purchasing Power Parity” theory tells us that if the nominal price level increases in one currency (assuming no price level change in the other currency) then the exchange must deteriorate in favor of the other currency by the same percentage. In other words, the real exchange rate should always be static. This theory does not always hold well in reality with currencies because of a number of confounding factors. However, gold does not pay interest and it does not have significant trade barriers making it perfect for this type of analysis.

The problem then becomes to determine what the real USD/Gold exchange rate should be and how does it differ from equilibrium. If it’s possible to determine this then it should be possible to say whether gold is under or overvalued.

To formalize equilibrium in terms of rates of change can be described as:

YoY Change in USD/Gold = YoY Inflation in USD – YoY Inflation in Gold

The first step would be to find out the inflation rates in both currencies. In the case of the USD it’s an easy task since we can use the YoY Nominal CPI. When it comes to gold it’s a little harder. In theory the “inflation” would be the amount of new gold being mined each year minus the amount being destroyed, however since I don’t have this data, we’ll give gold the benefit of having 0 inflation (no new gold being mined). As it turns out whether we make this assumption, or not, does not change the conclusion.

The equation then becomes really simple:

YoY Change in USD/Gold = YoY Inflation in USD

Which in turn can be substituted for with easily observable values:

YoY Change in Gold Price (USD) = YoY US CPI

This means that, assuming a starting point of equilibrium, any change in gold price which is not in line with a change in CPI will have to be eventually reversed because it temporarily changes the real gold exchange rate. In fact whether we start with equilibrium is irrelevant since our starting exchange rate will eventually revert to some constant number which should be observable with a long enough time series.

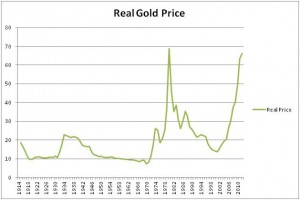

I started my time series in 1914 a few years before the fixed gold exchange was removed.

The chart was calculated using the following simple formula:

Real Gold Price (T)= Real Gold Price (t-1) * (1+ YoY Change in Nominal Gold Price – YoY CPI)

Looking at the chart it’s easy to see that the real gold exchange rate tends to revert to around 10 USD. It is also clear that there has been a parabolic rise in the real gold/USD exchange rate over the past 10 years or so. This cannot be blamed on observed inflation because we already took that effect out by converting the exchange rate to a real exchange rate. Therefore there must be a different reason why the real exchange rate has risen so far and three are likely candidates:

1) Change in Risk Aversion

2) Heightened inflation expectations not yet showing in the CPI numbers

3) Irrational Exuberance

It is clear that risk aversion has increased dramatically since 2008 but this does not explain the real gold price increase prior to that point in time. It is also a known fact that risk aversion tends to revert over time and we go through periods of heightened and lowered risk aversion. It would be hard to expect this effect alone to maintain gold prices at these levels.

Heightened inflation expectations are probably a better explanation and in fact we have historical proof these can increase the real price of gold much past actual inflation if we look at the late 1970′s. The gold prices at that time ran way ahead of inflation that never actually materialized, at least not to the extent that people expected. This means that despite the fact that gold moves in line with inflation it may not be a good inflation hedge if it already prices in years of increasing inflation.

I think we have a similar situation right now as we did in the 1970′s with a little irrational exuberance built in for good measure and a dash of risk aversion. The number of people expecting inflation to accelerate is overwhelming and they all want to buy gold to protect them from it. The problem is that the gold price has lost touch with inflationary reality and in fact even with inflation expectations.

To give perspective, it would take 30 years of 5% per year inflation to make the 2012 end of year gold price of $1,664 reflect 15 USD in real terms. That’s still 50% higher than the likely real exchange rate of 10 USD. In fact it would take 15 years of 10% per year inflation which is a level we’ve only seen three times since the gold standard was abolished (such inflation was common during the gold standard years). This means that if inflation truly did increase to 10% year gold investors should expect to receive a 0% return for the next 15 years.

I trust the nominal CPI numbers the US government releases are relatively close to the real inflation rate and I don’t really subscribe to conspiracy theories. However, for those readers that think the CPI does not reflect inflation I found a CPI adjustment that would justify today’s gold price. If the government, over the past 12 years, systematically underreported the CPI by a factor of 6 then today’s real gold price would be 15 USD. This means I multiplied each of the last 12 years CPI number by 6.

This to me seems extremely unlikely but I thought I would let my readers make up their own minds.

Since CPI shows little to no inflation and even agricultural commodity price ETFs such as DBA show little to no price pressures I think current inflation is an unlikely candidate to support the current gold price.

This means one of the following two things needs to happen to put things back into equilibrium:

1) Inflation must rise OR

2) Gold price must fall

Since we already discussed the first point in detail and pointed out that inflation would have to rise to hyper-inflation levels to support the gold price the more likely scenario is that gold prices will fall to match its long term real exchange rate with the USD.

Using the model and analysis above it’s possible to estimate the equilibrium price of Gold at $378. This does not mean gold price is likely to fall this far in a year or two; after all, the last time real gold price reached current levels it took two decades to return to equilibrium. However this equilibrium is a powerful force acting upon Gold price and it’s not out of the question to expect a large initial drop in the medium-term future followed by a sustained price pressure for a long time to come.