Following last month’s surprising surge in the Empire Fed from a deep negative number to 10.04, the March print was less exciting, declining modestly to 9.24, on expectations of an unchanged number. The new orders and shipments indexes remained above zero, though both were somewhat lower than last month’s levels, dropping from 13.31 to 8.18 and 13.08 to 7.76, respectively. Price indexes showed that input price increases continued at a steady pace while selling prices were flat. Employment indexes suggested that labor market conditions were sluggish, with little change in employment levels and the length of the average workweek. The Number of Employees index dropped from 8.08 to 3.23, back to September 2012 levels. Naturally, with reality worse than expected, all hopes were put in the future as indexes for the six-month outlook pointed to an increasing level of optimism about future conditions, with the future general business conditions index rising to its highest level in nearly a year. This is only the 4th year in a row in which optimism about the future is orders of magnitude higher than the current reality. Thank the Fed’s “wealth channel to support consumer spending.”

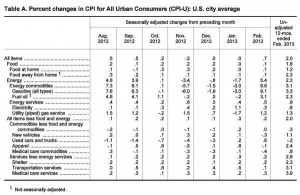

In other economic news, headline inflation came higher than the expected 0.5%, with the 0.7% sequential print the highest in one year, driven by a surge in the gasoline index which rose 9.1% in February, “to account for almost three-fourths of the seasonally adjusted all items increase. The indexes for electricity, natural gas, and fuel oil also increased, leading to a 5.4 percent rise in the energy index. The food index increased slightly in February, rising 0.1 percent.”

Luckily, since nobody needs food, gas or to heat their homes in winter, Core CPI ex food and energy was a tepid 0.2% increase in February, and 1.9% higher than a year ago – the number Japan’s Abe would kill to be able to goalseek as well.