Very recently, the head of the International Monetary Fund Christine Lagarde dismissed concerns on the currency war stating that -

There’s been lots of talk of currency wars, and we have not seen any such thing as a currency war. We’ve heard currency worries, not currency wars. We’ve not seen confrontation but deliberation, dialogue, discussions and clearly this G-20 meeting has been extremely helpful and productive.

Currency concerns would just be a subtle way of referring to the currency war similar to the subtle nature of the currency war. In this article, I will discuss one of the biggest evidences of the currency war and its implication on gold prices.

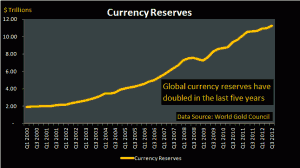

The chart below shows the global foreign exchange reserves from the year 2000 until the third quarter of 2012.

Global currency reserves have swelled from $1.9 trillion in the year 2000 to $11.2 trillion by the third quarter of 2012. More importantly, global currency reserve has doubled to current levels from $5.6 trillion at the beginning of 2007. This data, in my opinion, is the biggest evidence of the global currency war. First, it gives an evidence of aggressive money printing in order to survive the worst financial crisis since the Great Depression of 1929. Second, it gives an indication of aggressive stockpiling of other currencies in order to prevent one’s own currency from getting stronger. Also, the swelling of currency reserves points to an era of financial repression with countries trying to inflate their way out of excessive debt. I must point out here that the first factor incorporates gaining trade competitiveness in order to boost economic growth through a weaker currency.

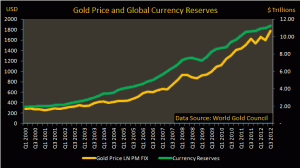

Before I discuss the reasons for believing that currency reserves will continue to swell, I would like to present a chart, which gives investors a clear idea of the relation between currency reserves and gold prices.

It is very clear that gold prices have moved in tandem with increasing currency reserves. There has been a 98% positive correlation between gold price and currency reserves in the last twelve years. This is very understandable as the supply of paper money is growing at a much faster pace than the supply of physical gold. Paper money would therefore depreciate against gold in such a scenario.

The important thing to discuss here would be – Will currency reserves continue to swell globally over the next 5-10 years?

The answer would be a big yes. The most important reasons would be -

The United States of America and Europe remain in a phase of sluggish economic growth with fairly large deficits. It would be in their interest to see a weaker currency, which might boost exports and also help in the ongoing financial repression.

The CBO expects another $10 trillion deficit in the United States over the next ten years. This deficit would be a source of additional global liquidity and the continued surge in currency reserves.

Japan has aggressively entered into the currency war with an inflation target of 2%. Going forward, highly expansionary monetary policies of Japan’s central bank will further catalyze the currency war with other countries getting aggressive in their efforts to devalue their respective currencies.

Export oriented Asian countries would also like to keep their currency stable or relatively lower. This will further contribute to the global currency conflict.

Considering these factors, there is no doubt in my mind that global currency reserves will continue to surge and will lend support to gold prices at higher levels. Deep corrections have been witnessed in secular long-term bull markets in the past across all asset classes. Investors should therefore consider the current correction in the precious metal as an opportunity to buy.

It is always a good idea to have physical gold as a part of the portfolio.