There’s a tendency in gold investing circles to overemphasize the unimportant while not placing enough emphasis on what really drives the market. For example industrial demand for gold and ETF interest are both closely monitored, but few actively track the gold coin and bar sales that account for a much larger share of yearly gold demand.

If gold coin sales are any indication, we’re in the midst of one of the most bullish periods for the yellow metal in its 10 year run.

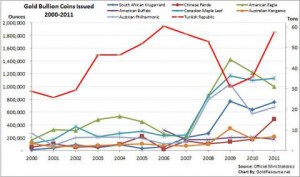

American Eagles sales in the first two months of 2013 totaled 430,500 ounces, up 52% from the same period in 2012. The Turkish State Mint, which has produced by far the most popular gold coin over the past decade, has seen demand pick up 35% in January and February of 2013 compared to the same period in the previous year. January Eagle sales were the sixth largest in history while Turkish gold sales in January was the most in a single month by quite a margin. Other mints fail to provide monthly data but the shift in demand usually happens in unison if we are to look at the chart below.

Coin sales in 2013 look destined to stampede past last year’s mark, but whether the total bar and coin demand will approach the record 1519 tons witnessed in 2011 remains to be seen. India and China made up over 40% of demand in this category in 2011, and with the gold price on the dip, it would be within expectations to anticipate Eastern markets viewing this as a buying opportunity.