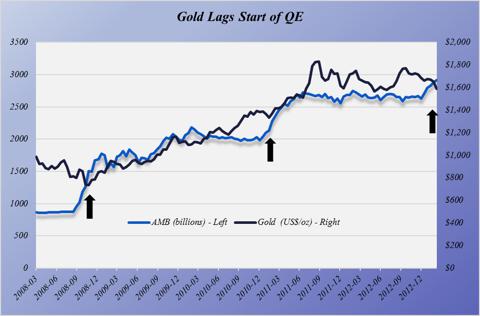

There’s been a lot of verbiage spilled over the situation in the price of gold (GLD). This is a difficult situation to handicap because of the sheer importance of this period in time. The Federal Reserve has been trying to talk down the inflation it is inviting through expansion of the monetary base by trying to make us believe that it would end its Quantitative Easing program within a few months. This has cast a pall over the commodity and gold markets as well as the Euro (FXE) which normally would rise on inflation expectations. This is not only not possible it is, frankly, laughable. But, the effects of QE, while not predictable in terms of timing, are unavoidable and will result in much higher gold prices.

Since the beginning of QE IV and the debasement of the Japanese Yen (FXY) began the price of gold has been trading opposite of the inflation expectations of the market. In other words gold is not responding to inflation worries and this has confused and confounded many within the community, myself included. Note the inverse behavior between GLD and the 5/30 Treasury and 5/30 TIPS spread, when normally GLD trades in sympathy with these.

A brilliant admixture of headline manipulation, savvy price suppression in the futures markets, interventions into the foreign exchange markets – Abenomics in Japan — and improving bank earnings have created a sense of calm that has soothed the markets collective worry and put a huge bid underneath the trade weighted U.S. Dollar index (UUP). This has allowed the central banks to lean on gold while funneling newly-printed money into the equity markets. My hat’s off to the Fed for creating this illusion. And I do still believe it to be an illusion.

As I pointed out in my article last week, the Dow Jones Industrial Average (DIA) may be making new highs but it is a relatively narrow rally. Major Dow components like Microsoft (MSFT) are still struggling even after putting in a technical breakout last week, only to see it fail and the stock stay range bound, for example.

The Next Phase of the Cleanup

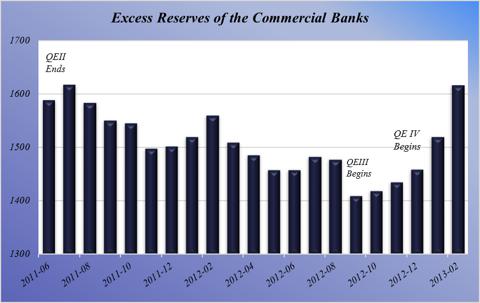

If the Fed’s stress tests and the earnings reports of the major banks are to be believed then we have nearly completed the de-leveraging phase of the cleanup post- Lehman Bros. The Fed has materially weakened its balance sheet – and continues to do so to the tune of $45 billion per month – but strengthened the major banks. If that is the case then the newly-created money the banks are flush with should be making its way into the economy through new lending. So, let’s look at the Fed’s own statistics on this.

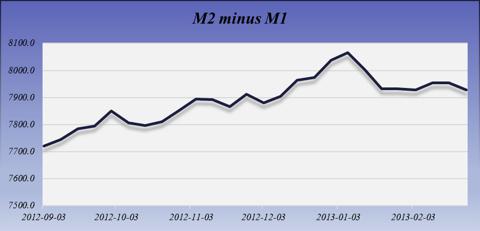

So, while the Fed was tightening excess reserves were falling. This would indicate a healthier banking system, one that felt it could generate a better return in the market than it could by having the Fed pay them 0.25% interest on the money. Now, with the Fed actively trying to drive savings out of the economy – which it is very successfully doing, look at the next chart – the banks are right back to getting cold feet again. All of the money that has been given to them via QE IV is landing right back in the Fed’s vaults. Now was this done just to pass the current round of stress tests after which the money will begin to flow like oil from a 19th century West Texas gusher?

If the banks are healthier than they were, and that is a distinct possibility the next phase of this cycle will come in the form of monetary debasement to pay off future liabilities in devalued currency. The political will in Washington D.C. is simply not there to take a meat cleaver to the budget so the current status quo of understating the CPI and unemployment rate will continue such that Social Security obligations can be paid back at a discount since annual payouts are adjusted for the CPI. At the same time debtors will be bailed out because that is who benefits from monetary debasement and that’s who will determine who gets re-elected. Savers have not been in charge of the U.S. Treasury’s purse strings for a long time.

The Demand for Savings

This is the purpose of QE, to drive what Keynesians feel is excessive savings out of the economy. This is, of course, patent nonsense a priori as the definition of excessive is completely subjective and therefore cannot be derived or even guessed at. But the Fed does believe it can guess better those who actually take the risks of putting their capital in play.

With every iteration of QE there is a time lag between its beginning and a rise in the price of gold. Ascribe what reasons you want to for it, but what is obvious by the headlines that the demand for physical gold as a form of savings is increasing. Savings in dollars is being punished with real interest rates being pushed down so saving in gold is the next recourse for people, institutions and governments. Once the disparity between the gold price and the reality of the money flow reaches a certain point gold is no longer available its current price. Then the scheduling problem takes over that Robert Blumen described so well and the price moves on the anticipation of there being lower future supply.

We are seeing very abnormal physical delivery on the COMEX so far in 2013. With the banks clearly telegraphing their own inherent weakness via their excess reserves, savings being driven out of the banking system by QE and the equity markets clearly running up against the limits of global fundamentals it is only a matter of time before that situation boils over.