While producing my recent works, Sell Gold and Silver Further on this Jobs Report and Annaly is the Big Beneficiary of Focused Mutual Fund Flows, I made an important connection. By now most investors are aware of the capital flow fuel being provided to stocks at the cost of precious metals and money market funds. Well, within those broad reaching trends, there are cross currents and side streams of capital acting in strange and perhaps unexpected ways.

It’s the reason I believe big dividend payers like Annaly Capital (NLY) and American Capital Agency (AGNC) are outperforming the market this year, something that would not be expected based on their beta coefficients near zero. In an enthused market like we have today, cyclical and prospective stocks with betas above 1.0 should be outperforming. But what is happening in the case of the mortgage REITs is that excess capital coming into stock funds is indiscriminately spread amongst all types of funds, including income funds. New money coming into income funds is certainly finding the big dividend payers, with these two offering double-digit dividends each. That’s why I recently recommended both for short-term investment.

The story with gold and silver is a bit different. They are part of the group of assets shedding capital to fund stock purchases. Yet, last week, when the Employment Situation Report came in positive, despite my interpretation of the understated unemployment rate (I find it to be 18%), something interesting happened. After I published my “Sell…Further” article, Goldman Sachs (GS) issued a short-term technical buy recommendation on the metals, reversing the day’s downtrend. However, I noticed that the SPDR Gold Trust (GLD) significantly underperformed the iShares Silver Trust (SLV) in the turn. Perhaps Goldman had a bit more to say about silver in its report (I have not seen it), or perhaps discriminating capital flows are favoring silver over gold.

The Skinny on Silver

Institutions and individuals seeking to preserve wealth stores with investments in metals are not stupid. They can see that capital is bleeding out of the metals, and they do not prefer to lose money in the short-term in order not to lose money in the future. Yet, at the same time, many want to have a safe haven position in mankind’s longest lasting currency, precious metals. Whether it’s because of a concern about the dollar and other fiat currency or because of an expectation for a stock slide does not matter. The fact is there is a group of investors that will always seek to have a safe haven position to preserve capital wealth.

Then, on top of that, there are a great number of institutions, which are determined to maintain a certain percentage of capital in an alternative asset class like gold. Most of such monies find gold and the gold ETFs like the SPDR Gold Shares Trust and the Market Vectors Gold Miners (GDX). But when gold fails, where will they go to if they want to maintain a dollar or stock hedge? Well, I love real estate today.

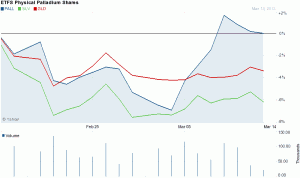

I’m lucky enough to have an avid metals investor and expert as a neighbor, who is likely reading this article and smiling now. He has helped me to see something interesting about how the metals investor mindset works. As I passed him one evening on the street, and we commiserated about the metals decline, he said he had a new idea. But instead of naming Google (GOOG) as his favorite on its new Google Glass gear or Apple (AAPL) on its valuation or its next best product, the guru stunned me by saying after a powerful pause, “Palladium!” Guess what, he was quite right too! See the performance of the ETFs Physical Palladium Shares (PALL) since.

So instead of choosing stocks, some investors in metals are finding other metals to keep their gold money safe for now. As I looked more into the investment options, I discovered a sparkly lady on Seeking Alpha pushing palladium for 2013 outperformance. Stephanie Collins also foresaw the latest rise in the metal, as she favored palladium and platinum in her February write up; others at SA spoke positively of the relative ETF securities including the PALL and the ETFS Physical Platinum Shares (PPLT). These metals benefit from cyclical drivers and uses, along with some jewelry use. In times of improving economics, supply constraints also act to lift the metals, but their outperformance is already notable this year.

For this reason, I’m looking to silver now too as a sort of intermediate. I think it could bottom before gold, and perhaps indicated that it would on the day of my last metals write-up. Silver draws interest for its currency value like gold, but it also benefits from significant jewelry usage, especially with gold prices so relatively high today, even after the latest drop. However, silver also has cyclical uses like palladium and platinum, and is demanded for commercial and industrial purposes. The way silver turned versus gold on the Goldman Sachs report last week showed me silver might have less downside risk than gold near-term and might even benefit from gold selling as well. Furthermore, it could be a sort of mezzanine destination for capital as it again transitions eventually from palladium and platinum back to gold, if there truly is some mixed metals trading going on as it appears to me.

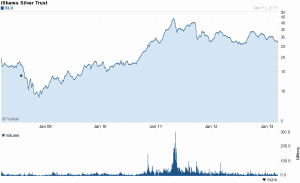

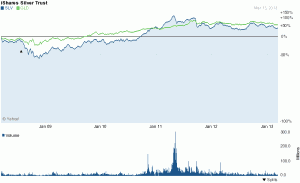

The iShares Silver Trust has certainly benefited from growing uses and demand for silver, and represents a popular way to play silver. It is well off its peak touched in 2011. As stocks have risen since late last fall, the SLV has declined with the GLD, but it has tested for demand along the way. While I’m not a technical analyst, I see a sort of bottom settling in here on a longer-term trend higher. Over the last five years, silver has closed the valuation gap on gold, backed off and then reached again.

In the more recent turmoil, it exaggerated downside, but over the last week is outperforming (SLV vs. GLD). The gold to silver ratio is on the decline since the very end of February, and appears set to further contract, which speaks for silver near-term in my view, at least on a relative basis to gold.

I expect silver to continue to benefit as an alternative to pricey gold in terms of currency and jewelry. Its expanding use in apparel and other commercial and industrial purposes, including water purification, make it interesting in all sorts of market environments. Given the transition question I believe will increasingly be asked after gold’s precipitous drop and the exhausting of a good deal of capital funding resources for stock buying, I think it’s prepared to recover sooner than gold.