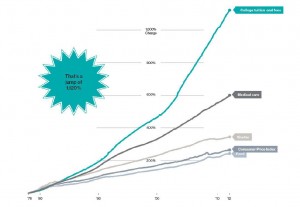

For those who, like Time magazine and its exhaustive treatise on soaring healthcare costs, are shocked and confused how it is possible that prices for some of the most rudimentary staples, among them basic medical care and college tuition, have exploded we have the answer. In fact, we had the answer in August 2012, when we showed our “Chart Of The Day: From Pervasive Cheap Credit To Hyperinflation.” We will take the liberty to recreate the chart from 7 months ago here:

As the title, and chart, both imply, the simple reason why college tuition is up 1200% in 35 years, while healthcare fees have soared by a neat 600% or double the official cumulative inflation, is two words: “cheap credit.” This is also the reason why the BLS and the Fed can get away with alleging inflation is sub-2%: because the actual cost for any of these soaring in price services is never actually incurred currently, but is deferred with the only actual outlay being the cash interest, which as everyone knows is now at the ZIRP boundary thanks to 4+ years of ZIRP and three decades of the “great moderation.”

Of course, if one actually were to calculate inflation by how it should be captured in a world in which half the base money is in the form of reserves which are only used to fund risky asset purchases (for now), which includes nominal stock and bond levels, it would be will in the double digits, but that is an exercise for a different day.

Which is why we are confident it will come as no surprise to anyone, especially not those who have no choice but to follow the herd and pay exorbitant amounts for a generic higher education that has negligible utility at best in the New “Okun’s law is terminally broken” Normal, that tuition at public colleges jumped by a record amount in the past year!

WSJ has the full story:

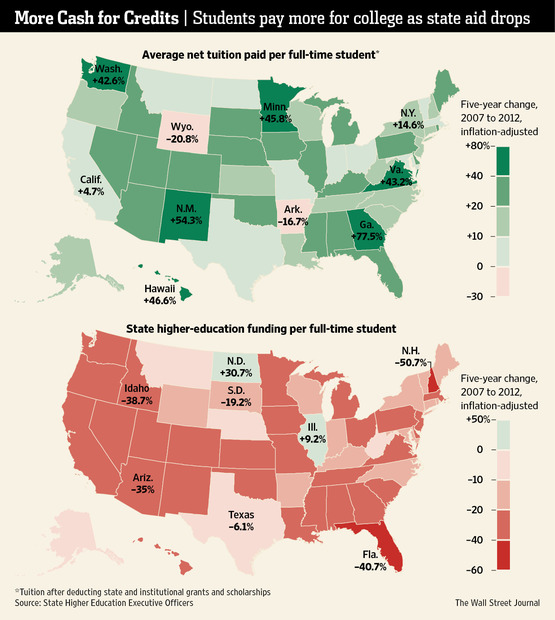

The average amount that students at public colleges paid in tuition, after state and institutional grants and scholarships, climbed 8.3% last year, the biggest jump on record, according to a report based on data from all public institutions in all 50 states to be released Wednesday by the State Higher Education Executive Officers Association. Median tuition rose 4.5%.

A big factor for the plunge is that the states housing the colleges are just as broke as virtually every other for-profit entity in the developed world:

The average state funding per student, meanwhile, fell by more than 9%, the steepest drop since the group began collecting the data in 1980. Median funding fell 10%. During the recession, states began cutting support for higher education, and the trend accelerated last year.

Rising tuition costs are “another example of the bind that public institutions are in,” said Sandy Baum, an economist at Skidmore College. “Unless we make public funding a higher priority, the funds are going to have to come from parents and students.”

And therein lies the rub: because broke states need cheap credit to continue their externally-funded existence: the same cheap credit that allows students to indiscriminately pay soaring tuition costs, and take out any amount of loans since they don’t have to worry about the current cost of such an education at the current moment. Obviously the price elasticity would be far less if student could only afford colleges they had savings to pay for. And by the time the loan comes due… well, that is bridge the delighted student (who just purchased two iPhones with the first loan installment) will cross in many many years.

Sure enough, it is the cheap loans that are the true antagonist both here, and in the parallel show describing the horrifying picture surrounding America’s cost-exploding welfare state. Only there it is tens of trillions of socially spread out and underfunded liabilities that are allowing the same price “elasticity” that has sent costs through the roof in the past three decades (and is the answer to Time’s expansive healthcare cost quandary).

Kaylen Hendrick, a senior at Florida State University in Tallahassee majoring in environmental studies, is graduating in three years rather than four in order to keep costs and borrowing down.

“Growing up, I thought if I made good enough grades, that college would not be a problem,” said Ms. Hendrick, 20 years old, who has taken out about $15,000 in student loans and works 20 hours a week to pay for college.

State funding for the State University System of Florida has declined by more than $1 billion over the last six years, even as enrollment has grown by more than 35,000 students, a spokeswoman for the system said.

Nationally, average tuition, after institutional grants and scholarships, increased to $5,189 in 2011-12 from $4,793 a year earlier, according to the report, which is based on the 2011-12 academic year and adjusted its figures for inflation. Tuition revenue accounted for a record 47% of educational funding at public colleges last year.

In addition to raising tuition, many states have pared spending. The California State University System declined to take the vast majority of transfer students this spring and has turned away about 20,000 students who qualified for admission during each of the past three years, a spokesman said.

Society’s loss: 20,000 less Bolivian wicker basket majors roaming the streets. But trust us kids: when all is said and done, unlike the BLS, your inflation wallet will be unable to “exclude” all those things that have soared in price (such as your largely worthless education) and ending up miraculously with, drumroll, a sub 2% CPI for years and years and years.

Because all those trillions in student loans are coming due one day, and when they do, that 1200% rate of increase in college prices (and rising) will make it all too clear that while one can hide inflation for a brief period of time in mountains of debt, the cost always comes due.