The price of silver has been steadily falling since April of 2011. Yet the U.S. Mint is having trouble keeping up with demand for One Ounce American Silver Eagles, as gold dealers tell their customers they will have to wait a week to a week and a half for delivery, and junk bags of the 90% silver coins (the silver coins in use before 1965) are harder and harder to come by. Even with this decline in prices, ETFs like iShares SLV are showing a pent up demand for silver that doesn’t seem to want to end despite lower prices.

- March 25: 343,645,323.100

- March 11th: 342.292.222,100 ounces

- March 1st: 342.433.205,000 ounces

- Feb 8th: 335,858,876.200 ounces

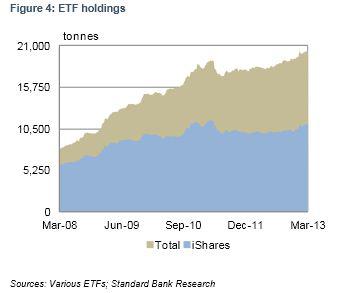

The following chart shows overall increase in ETF silver demand has risen the last few years.

While it is easy for those who own silver represented by ETFs to sell with the stroke of a key, why aren’t they selling? Perhaps the answer can be found in the mindset of the ones who buy physical gold and silver as many of them own ETFs as well.

People who buy physical silver aren’t calling and selling their coins. Why is this? Why do those who buy physical metals not sell when the price drops? We will look at two of the most popular products, One Ounce American Silver Eagles and the 90% “junk” silver bags and try and answer that question.

90% “Junk” Bag Silver Coins

What are “junk” bags of silver and why are they so popular? Junk bags are the 90% silver coins with a date earlier than 1965 that were once circulated here in the United States. They can be dimes, quarters or half dollars. Most of the coins today are just dimes and quarters because half dollars are almost impossible to find any longer.

The mindset of the person who buys 90% silver coins is to buy them to use as barter coins if our economy were to get to a point where the dollar is no longer trusted. As hard as this is to imagine, think for a moment what has already occurred with most not even realizing it.

A 1964 Roosevelt dime could buy you a loaf of bread in 1964. Today, that same exact dime can buy you a loaf of bread with its silver content at $2.06 according to coinflation.com. A 1965 Kennedy dime could buy you a loaf of bread in 1965 too. But what can that same 1965 Kennedy dime buy you today? It still has the purchasing power of 10 cents. This is what the government has done to our money.

In fact, a $1,000 face amount of pre-1965 quarters and dimes goes for just over $22,000 today.

This is why those who buy 90% silver junk bags hoard them. It is peace of mind that knowing if they ever need it, they have something to barter with that has held its purchasing power over time. I imagine many in Cyprus right now are wishing they had something to barter with as their access to their cash has been denied.

American Eagle One Ounce Silver Coins

One ounce silver American Eagle coins are what I consider to be the most beautiful coins in America. People pay much more in spot over the second most popular coins, the Canadian Maple Leaf silver One Ounce coins, because they are just more highly sought after. Even looking at prices on Ebay, you rarely see Canadian Maple Leaf silver coins, but there are auctions for the American Eagle silver coins every day.

Part of the reason for the January increase in popularity of the American Silver Eagle coins is many gold dealers buy them and then get them slabbed by PCGS and mark them up in price as a graded coin (slabbed refers to an expert grading or numeric rating of the coin based on its own merits to include marks and overall condition and put in a coin holder to keep it in that condition). Dealers pay a small fee to have this done for them.

When a coin comes straight from the U.S. Mint in a sealed box, then the odds of that coin getting a grade of 70, the highest numeric grade it can receive, are greater. The higher the grade, the more the dealer can charge, and thus the more commission they can make off the original bullion coin they bought from the U.S. Mint. This can explain why the U.S. Mint at one point ran out of American Eagle Silver coins in January of this year.

Personally, I recommend people buy silver as low a cost to spot as possible which you can do with the American Eagle, Canadian Maple Leaf and 90% junk silver bags. There is no need to pay more for your silver just to possess a shiny coin. If we ever did get to a barter situation, no one will care how shiny your coin is. They will just want to know its weight in silver so they can calculate how much you can purchase with it.

But beyond January, the American Silver Eagle coins sales have stayed strong. They have stayed so strong in fact, that many dealers have to tell their clients that it will take longer to receive the metals. It is important to keep in mind that these types of issues are occurring with the price of silver not really going anywhere. What will occur should the price of silver begin to take off again? I guess we’ll find out soon enough.

Conclusion

I have been receiving many calls lately of people selling their silver ETFs like SLV and converting the proceeds to the physical 90% silver junk bags and one ounce American Silver Eagle coins. I expect this trend to grow, especially as the turmoil in Europe unfolds next into other surrounding countries where some are being told to withdraw cash from their banks now, before the crisis hits them. A crisis I have been warning about for a few years now when I mocked the results of the first European bank stress tests in July of 2010.

In January I was recommending silver over gold and silver seems to be holding up well of late. That doesn’t mean it won’t test the lows and dip below $25 before the price takes off again, since the U.S. dollar has been the beneficiary of European turmoil and silver will typically trade inverse of the dollar. I believe the dollar will continue to move higher, as I have written, because of this European turmoil, and silver will bottom out and take off in price despite any potential move higher in the dollar at some point. I will write a bullish article on silver when I see things line up. Dollar cost averaging into a position in silver is still what I recommend. But a holder of physical silver cares not that the price falls 10% or more on its way to much higher prices in the future. The holders of silver have proven this with the most recent fall in prices, as no one is selling.