Summary: Our government’s runaway borrowing is risking runaway inflation. One way We the People can limit that risk is to practice, in advance, the use of optional, alternative currencies — specifically those based on gold or silver coin and bullion. Starting with coins in our pockets and moving to gold- and silver-bullion debit cards, it’s a way for the states to survive the Federal Reserve’s debasement of our currency. It’s legal, it’s Constitutional, and some states, including Arizona, have already taken the first steps.

——————–

They just can’t help themselves. Governments and their central banks around the world just can’t stop creating and printing new money at a pace that far exceeds their country’s production of new goods and services. This is an open invitation to severe inflation, and it’s coming soon to a country near you — like the one you’re in now.

In America, a mushrooming entitlement state, a gargantuan debt that is rising exponentially, and a complicit Federal Reserve Bank are the culprits. But similar practices are doing their damage in countries all around the world. In Argentina, more advanced versions of America’s policies have have led to a currency inflation that is now raging at over 26% per year. America may only be a few years behind Argentina.

This is serious stuff — really. The world needs stable currencies because it is only money that makes it possible for human beings to deal with one another peacefully and voluntarily for mutual benefit. Without it, the world would revert to coarse barter, theft, violence, chaos, and anarchy — followed swiftly by dictatorships.

As Ayn Rand’s character Francisco D’Anconia put it in Atlas Shrugged (1957):

So long as men live together on earth and need means to deal with one another – their only substitute, if they abandon money, is the muzzle of a gun.

…

Whenever destroyers appear among men, they start by destroying money, for money is men’s protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. … Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked, ‘Account overdrawn.‘

…

When money ceases to be the tool by which men deal with one another, then men become the tools of men. Blood, whips and guns – or dollars. Take your choice – there is no other – and your time is running out.

(This is only a small excerpt from D’Anconia’s iconic “Money Speech”. The full version is worth reading and re-reading — at least once per year.)

So what can citizens around the world do about irresponsible money supply expansion? Complain? Sign petitions? Demand that new-money creation cease? Demand that the money supply be rolled back?

Good luck. In Big Governments everywhere, virtually all the incentives favor still more new-money creation, faster and faster, seemingly without limit. After all, newly created money can pay off (“monetize”) government debts, buy votes with expanded social services, and reward cronies with contracts for everything from paper clips to aircraft carriers.

So what’s the harm in all this?

The systemic harm is inflation. We all know that prices for gasoline, electricity, eggs, meat, bread, and other necessities have been rising, despite Big Government’s manipulation of the Consumer Price Index in a vain attempt to hide it. For seniors, the purchasing power of a lifetime’s worth of retirement savings is bleeding away, slowly at present, but much faster in the future. In the words of Paul Volcker, the former Fed chairman widely credited for clamping down on the runaway inflation of the 1970′s:

[Inflation is] a cruel and maybe the cruelest tax, because it hits in an unexpected way, in an unplanned way, and it hits the people on a fixed income hardest.

And yet Big-Government politicians, especially those that loudly proclaim to “care” about the poor and elderly, are implicitly robbing their citizens blind through the hidden tax of inflation. And it’s only going to accelerate.

So — are we helpless? In our earning years, of course, we can try to save more and invest our savings in ways that will try to keep pace with inflation. But if our own Federal Reserve Bank continues to produce new dollars at a rate that far exceeds the growth of new goods and services (GDP), severe inflation is virtually inevitable.

There is, however, something we can do as a fallback protection measure: prepare.

We can prepare for a currency crisis, and the devastation that may come of it, by having alternate, sound, competitive currencies already in circulation. We can practice using those currencies ahead of time so that as citizens, we come to understand and accept alternate currencies. And we can implement modern electronic means of using those currencies, thereby having the infrastructure all in place if and when inflation spirals out of control.

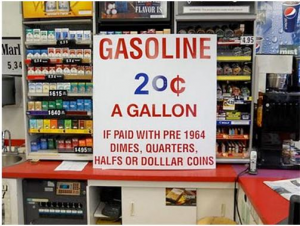

We can start small, on a state-by-state basis, with each state learning from the experience of others. One way would be to use already-existing silver and gold coinage from the US Mint. For example look at the image (at right) of a sign posted in a general store. There, the proprietor is offering to sell gasoline for only 20 cents per gallon, provided that payment is made in US coins minted in 1964 or earlier. Wow — 20 cents per gallon? Is the proprietor crazy? At my local gas station in Arizona, today’s gasoline costs $3.97 per gallon!

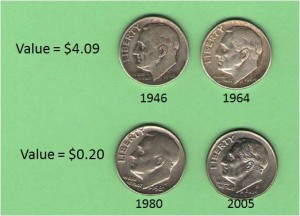

It turns out that the proprietor is not crazy. The silver content in two dimes, date-stamped 1964 or earlier, is actually worth more than $4.00.

Dimes, quarters, half-dollars, and dollar coins minted in 1964 or earlier have a silver content in troy ounces that is equal to 0.715 times the face value of the coin in dollars.

So two dimes have 0.715 x 0.10 x 2 = 0.143 troy ounces of silver in them. As of the date of this writing, the spot price of silver is $28.58 per troy ounce. Thus the silver value of those two old dimes is 0.1430 * 28.58 = $4.09. If anything, the proprietor is actually charging a premium for his gasoline!

Is a transaction like this legal? Yes, it is. Under our Constitution, states can declare a currency legal in their state provided that the currency is “gold or silver coin.” Article I, Section 10, “Powers prohibited of States”, reads as follows:

Several states have already drafted or passed legislation that would explicitly (re)declare silver and gold coin to be legal tender within their state. In particular, in Arizona, the Senate has just passed Senate Bill SB1439 that would make gold and silver legal tender in Arizona. The bill is mercifully short — barely half a page. It includes these key features:

1. Unless expressly provided by contract, a person may not compel any other person to tender or accept gold or silver as payment.

2. The exchange of one form of legal tender for another does not give rise to liability for any form of tax.

3. Gold and silver coin or bullion is money and is not subject to taxation or regulation as any kind of property other than money.

Note that use of gold or silver would be completely voluntary, which is as it should be. Those who do not fear inflation and have full faith in paper Federal Reserve Notes (which are no longer backed by anything other than the paper they’re printed on), can go right on saving and spending their wealth that way.

So where can one find these old silver-content coins? Not surprisingly, they disappeared from general circulation shortly after 1964, but they can still be purchased and sold as “junk silver” from many sources, including online sources.

Using these old coins is a good way to get started because it doesn’t require the states to mint any new coins. But it’s clumsy. The smallest US silver coin (the dime) is worth over $2.00 today, and the smallest US gold coin is worth over $150. How does one make change?

If we’re to be serious about an alternate gold- or silver-based currency, a much more convenient form would be gold/silver-backed debit cards issued by banks. At least one bank now offers such a card. It appears to be available in any country except the United States. Bummer. At some point, a competitive market in such accounts would go a long way toward protecting us from some of the ravages of government-debt-driven inflation.

Independent-minded states like Arizona might work with banks to offer gold/silver debit accounts, initially for intrastate exchanges only. Other states may do the same, and Americans may grow used to pricing goods and services in grams of silver or gold as well as in dollars.

Of course these new gold- and silver-backed accounts wouldn’t be “free” to use, as many traditional checking accounts are. While we could expect a competitive market to develop for gold and silver debit-card services, there would necessarily be some storage and transaction fees involved. But that may be a small price to pay for at-the-ready protection from runaway Federal Reserve Bank printing presses!