Today 40-year veteran, Robert Fitzwilson, wrote the following piece exclusively for King World News. Fitzwilson, who is founder of The Portola Group, urges investors to keep in mind, “Nothing has changed whatsoever as far as the case for gold and silver … The case for energy and the precious metals has never been stronger.”

“Many decades ago, Memorex Corporation created a very successful advertising program that lingers in our minds to this day. They recorded the great Ella Fitzgerald while she sang a note that shattered a glass. They would then replay the tape, and the recording also shattered a glass. The audience was asked, “Was It Real, Or Was It Memorex?”.

When it comes to the stock market, the question on the minds of most investors is “Is it real, or is it the Fed?”. We have concluded that it is both….

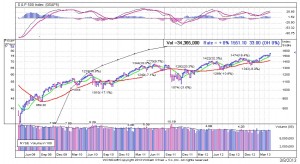

“Below is a chart for the S&P 500. This index is the standard by which professional investors judge market conditions. This index is weighted by market capitalization. The more valuable the individual stock, the more impact it will have on the Index. We saw this in the late ‘90s as companies such as Microsoft, Intel and Cisco dominated the Index. It is very clear that the Index has broken out to the upside. One reason might be that institutional investors have huge amounts of money and tend to be relatively risk averse. As portfolios are built, managers tend to stick to the marquis names at the start of the cycle. If it turns into a major bull market and there are large inflows, medium-sized and then smaller issues are purchased when the flows overwhelm the smaller number of “blue chips”.

The next chart is a very broad stock market indicator, the Value Line Geometric Index. This particular index comprises over 1,600 issues and assumes that an equal amount of dollars are invested in each issue. While the S&P 500 says “breakout”, this index is telling us a bit of a different story. It has not clearly broken out, yet it is threatening to do so. It also is consistent with the institutional herd mentality to start with the well-recognized names first.

There is a tendency for people to talk about “real estate” or “the stock market”. The reality is that real estate really represents individual properties and markets. The same is true for the stock market. It is an immensely varied collection of publicly traded companies. There rarely are moments when the collection of properties and companies can be lumped under just two descriptions.

We hear that stocks are over-valued. It really depends. Great growth companies are always expensive. If the intervention of the central banks has caused multiples on marquis names to become expensive, the successful targeting of nominal GDP could cause those multiples to tumble. We tend to favor cash flow over reported earnings. There are many solid companies that are generating significant cash flows that have grown right through the macro economic, political and monetary events upon which we have all recently focused. Caution was wise last year as we ran through a gauntlet of risks to the stock and bond markets, but the comments by Chairman Bernanke made it clear that the Fed believed it could prevent disorderly markets and intended to do so.

The central banks are going to continue to target stock prices and nominal GDP. Tremendous amounts of liquidity will be created in a massive, global and coordinated effort by the G-20 to jolt nominal GDP higher. The central bankers have a strong belief that rising stock prices creates the “wealth effect”. This wealth effect causes people to feel better and more likely to spend and expand their business activities. The wealth effect is real.

There really is no other politically practical choice at this point. Either the nominal value of assets and GDP catch up to the monstrous amount of debt and obligations or there is no chance that that the existing debts and accumulating obligations can ever be satisfied. Some correctly argue that there is no amount of targeting GDP that could balance the books. However, that means the currency reboot, repudiating of obligations and lots of unhappy people. We can see why targeting nominal GDP and hoping for the best over a long period of time seems more palatable to the central bankers.

Nothing has changed whatsoever as far as the case for gold and silver. In fact, it appears that some form of stasis has emerged. Despite unbelievably huge firepower thrown at suppressing the paper prices of the precious metals, there does appear to be a floor in the making. That does not mean, however, that there is not a ceiling in effect, too. While opposing forces might have set in some form of a floor, it is foolhardy to assume that the central bankers are out of capacity to enforce a ceiling. For the moment, the smart move continues to be to load up on the smashes and hold back on the rises in the mid-30s. If there were to be a breech in the ceiling, it should be easily recognizable.

If boosting nominal GDP is successful without a Black Swan type event in the fixed income markets, the ingredients for a major move to the upside in equities is possible. There is a massive over-allocation to cash and fixed income at the present time. If the evidence conclusively shows that a broad breakout has occurred, there could be quite a scramble to get back in.

The case for energy and the precious metals has never been stronger. However, as long as the central banks are executing their plan to boost equities and nominal GDP, it is unlikely that we will see a runaway event without a failure on one of the exchanges where these items are quoted and delivered. In the meantime, investors need to keep an open mind and look for other real assets in the form of companies with great growth prospects and healthy cash flow. Remember, for those that think the stock market is a one-way street, the Value Line Index is simply at break even since September of 2011, and there were three very painful declines along the way.”