The Bullish Case

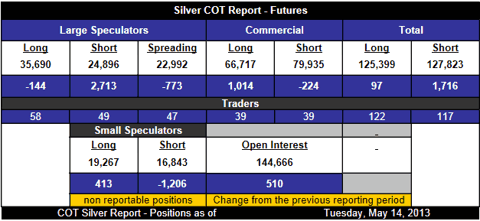

The best argument why silver may be headed higher is the Commitment of Traders Report (the COT). For those that aren’t aware, this report is one of the best predictors of the future price movement of silver. It shows the net long position of the large speculators (i.e. hedge funds and managed futures funds) and the net short position of the commercials (i.e. bullion banks like JP Morgan and HSBC). The hedge funds always hold a net long position and the commercials always have a net short position. I have monitored the COT reports for about 10 years and this has always been the case. It is unclear why the commercials are always short silver, but some speculate that it is market manipulation.

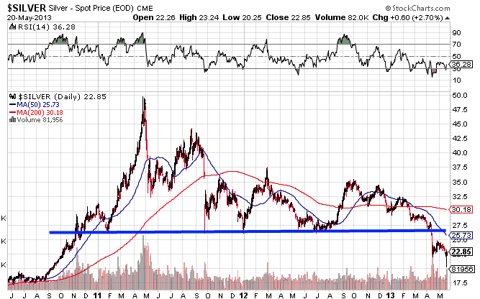

So basically when the hedge funds have a small net long position then that is bullish for silver. It is bullish because the funds are not overleveraged on the long side and have the potential to buy and push the price of silver up. On the other hand, when the hedge funds have a large net long position then that is bearish for silver because they eventually will need to sell those positions. And because a lot of these funds are technical traders who don’t care about the fundamentals of silver but only the chart patterns, they can be shaken out of their long positions if key support levels are broken. Look at what happened when the key $27 support level for silver was broken in April. That $27 support level had held at least six times before it was finally broken last month.

This past week’s COT report is extremely bullish for silver. The hedge funds have a net long position of 10,794 contracts. That is extremely low. Over the past 10 years, the range has been from about 6,000 to 70,000 contracts net long. So we are near the bottom of that range and that is bullish for silver.

This week’s COT report, which will be released on Friday, will give us the long and short positions as of the end of today (Tuesday). If you want detailed analysis of the silver COT report, I would recommend Ted Butler’s service. His commentary used to be free, but unfortunately it is now a paid service.

Final Thoughts

The COT report argues for a rally in silver, or at least an end to the selling. Despite the COT report and despite the fact that I am bullish on silver in the long-term, I think a move below $20 is still possible this summer. This is due to the fact that silver usually struggles during the summer months from May to August. It has declined in price during this period in seven of the last twelve years. There is also a technician I follow who is predicting a move to the $17-19 range this summer. Thus, I sold about 10% of my position in the largest silver ETF (SLV) last week and reinvested the proceeds into the general stock market. I intend to buy it back this summer if silver declines to roughly $18. However, if silver rallies from here into the mid-$20s then I won’t chase it higher.