Gold climbed $15.50 or 1.21% on Friday and closed at $1,294.00/oz. Silver reached a high of $20.121 and finished up 2.19%. Gold and silver were both down on the week -6.93% and -9.07% respectively.

Gold has fallen another 1% this morning and remains at its lowest level since September 2010.

While gold rose over 1% on Friday, it recorded its worst weekly performance – down nearly 7% – since September 2011.

Support & Resistance Chart – (GoldCore)

Traders are the most bearish in 3 1/2 years, with 15 analysts surveyed by Bloomberg expecting prices to fall this week. Six were bullish and five neutral, the largest proportion of bears since January 2010. Gold rose in February 2010 and was 27% higher by year end 2010.

Sentiment is as bad as we have seen it in many years which is bullish from a contrarian perspective.

Weak hands have been washed out of the market and strong hands are accumulating again on this dip and will continue to do so in the coming weeks.

Gold, May-June 2013 – (GoldCore)

Gold’s 14-day relative strength index remains near the level of 30 that indicates to many technical analysts that a rebound may be imminent.

Falling gold prices are beginning to impact the gold mining sector in a big way. Newcrest Mining Ltd.’s decision to write down the value of its mines by as much as A$6 billion ($5.5 billion) will lead to the biggest one-time charge in gold mining history. It also heralds pain for competitors.

Barrick Gold Corp., the world’s biggest producer, Newmont Mining Corp. and Gold Fields Ltd. may be next, according to Jefferies International Ltd.

Canadian miner Barrick Gold will announce more job cuts and potentially the closure of mines in Western Australia. Barrick, the world’s largest gold miner, has already trimmed its WA staff by 60 people this month. Around 100 jobs are set to be cut from the group’s regional head office in Perth, with more losses – or potentially partial closures – likely at Barrick’s five mining operations in WA.

This will lead to a decline in mining supply which will support prices.

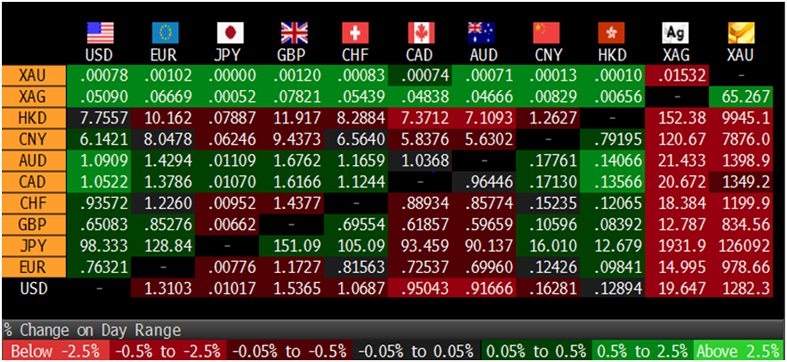

Cross Currency Table – (Bloomberg)

Gold jewellers and bullion dealers in India, soon to be the world’s second largest buyer after China, will be asked to suspend sales of gold bullion bars and coins to retail investors to support government efforts to narrow a record current-account deficit that’s pushed the currency to an all-time low.

The All India Gems & Jewellery Trade Federation, a group that represents about 300,000 gold jewelers, manufacturers, wholesalers, retailers and distributors, will send notices to members asking them to halt sales.

Ron Paul still likes gold. In fact, he thinks it could go to “infinity.” Below is his interview with CNBC’s Jackie DeAngelis and the Futures Now Traders from June 18th.

CNBC’s Jackie DeAngelis:

“Looking sort of at our economy and at the global economy, and were watching the situation in Japan closely as well, Why isn’t gold responding more?”

Ron Paul:

“Well you know if you look at the last 13 years it was up 12 out of 13 and this year isn’t even over yet, so I would say its responded pretty well. But you might say well yeah what about in the last year why hasn’t it? Well, markets do these things they go up sharply and sometimes they take a rest. But the long term is something you can get a handle on, but I was never very good on short term, whether it’s the stock market or whatever, or what government will do, they are just all over the place.

I think If you look at the record of the value of the dollar since the Fed’s been in existence we have about a 2 cent dollar where gold was worth $20/oz.

I would say the record is rather clear on the side of commodity money.

And history is on our side, 6,000 years of history shows it maintains value while paper money self destructs.

I would say that long term as long as we have excessive spending and excessive computerized money you’re going to see gold go up and eventually if we’re not careful it could go to infinity while dollar could collapse totally.”