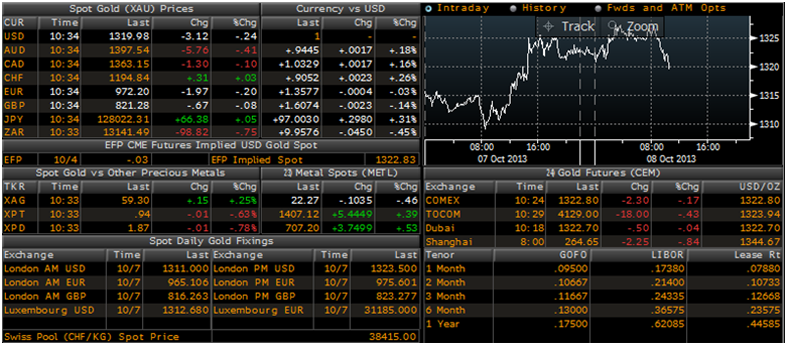

Gold climbed $11.80 or 0.9% yesterday, closing at $1,322.40/oz. Silver soared $0.65 or 3% closing at $22.33. Platinum climbed $15.89 or 1.2% to $1,396.49/oz, while palladium rose $2.47 or 0.4% to $699.47/oz.

Gold is being supported as the U.S. government shutdown that continues with no end in sight and the deadline to raise the national debt ceiling looms, burnishing gold’s safe haven appeal.

Prices also found support from China, which reopened after a week-long National Day holiday.

Asian demand and Chinese demand in particular remain robust. China’s August gold imports from Hong Kong were a strong 131,423.7 kilograms, the Hong Kong government announced today and dealers in Hong Kong said they were seeing good buying interest from China.

Gold and the US Dollar Index – 5 Years – (Bloomberg Industries)

The October 17 deadline to raise the $16.7 trillion debt limit is approaching fast and concerns about an unprecedented default have been expressed by well known and politically connected investors including Warren Buffett.

A default would be a global financial disaster of a scale even bigger than that of the Lehman Brothers collapse and subsequent financial and economic crises.

The $12 trillion of outstanding government debt is 23 times the $517 billion Lehman owed when it filed for bankruptcy on September 15, 2008.

Some fear that it would be an economic calamity like none the world has ever seen and the likes of Buffett have warned that going over the edge would be catastrophic.

The uncertainty around the debt ceiling will put paid to nonsense talk regarding the Federal Reserve ‘tapering’ any time soon. This should also contribute to higher gold prices.

In the last 20 years, there have been only six instances of both the U.S. dollar and gold falling more than 3.5% in a 30 day period. A decline of 3% or more in the DXY (the trade-weighted dollar index) has historically led to higher gold prices, given that gold is commonly priced globally in dollars and dollar weakness often leads to safe haven demand for gold.

The dollar has fallen slightly recently with the decision not to taper, the government shutdown and the debt ceiling debate. Investors seemingly are not choosing the safe haven of gold, thus far.

Gold in USD, 1 Year with Support and Resistance

This is due to concerns about recent counterintuitive price movements and what appears to be price capping at key technical levels. There are still concerns that there may be further price falls in the short term and this uncertain short term outlook is deterring many buyers, especially in western markets.

The appalling fiscal and monetary situation in the U.S. will lead to further dollar weakness in the coming months. This weakness will be most manifest versus gold as other fiat currencies have their own risks.

In these uncertain times, all owners of gold and those considering owning gold should acquaint themselves with the most appropriate storage options for their own particular circumstances.