Chinese gold import data have just been released for August, and it shows that imports are still very strong. But what investors should really take note of is that imports into Hong Kong were close to 300 tonnes in August – which would put them on pace to suck up all of global mine supply.

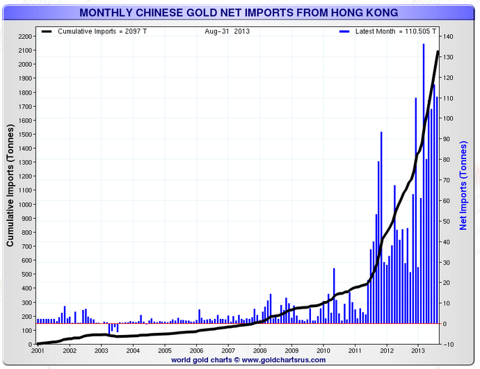

Net imports into the Chinese Mainland, after deducting flows from China into Hong Kong, were 110.5 tonnes, down slightly from the close to 120 tonnes a month earlier. Mainland buyers purchased 131.4 tons in the month, including scrap, compared with 129.2 tons in July, data today from the Hong Kong government show. In terms of year-over-year changes, Chinese mainland buyers purchased 53.5 tonnes last year, which means that gold purchases more than doubled – which is clearly shown in the chart above.

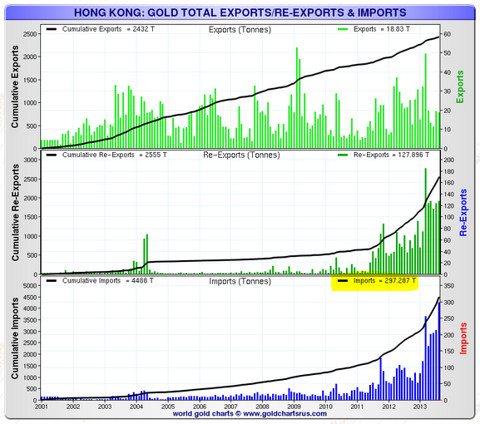

But what is really interesting is that Hong Kong imports of gold increased to 297 tonnes – which is the largest amount of gold imports on record as investors can see in the chart below.

If these 297 tonnes are extrapolated over one year, they would be equivalent to 3600 tonnes of gold or significantly higher than all of world gold mine production – that is a staggering amount of gold being imported into Hong Kong.

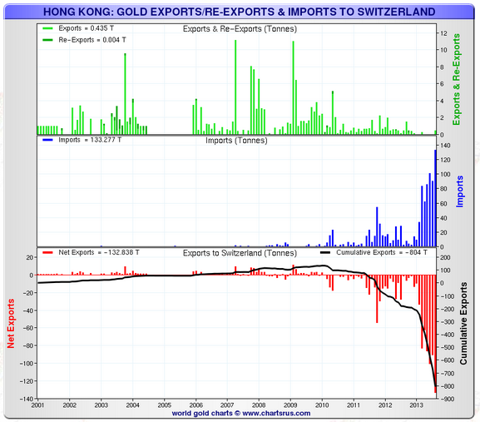

Digging a little deeper we find that the two countries that exported the most gold to Hong Kong during the August period were the United States and Switzerland.

According to Hong Kong ministry records, both of these countries exported the most gold ever to Hong Kong in August, with the U.S. net exports totaling 32.58 tonnes and Swiss net exports totaling 132.8 tonnes. High Swiss exports makes sense since Switzerland is the world’s refiner of choice and most scrap gold travels to Switzerland to be refined and re-exported.

But U.S. exports of 32.58 tonnes are a bit surprising since the U.S. only produces anywhere from 15-18 tonnes of gold per month and gold production totals have been dropping as miners like Barrick Gold (ABX) and Newmont (NEM) have experienced falling gold grades. That leaves more than 15 tonnes a month of existing U.S. gold stocks that are being exported to Hong Kong – and that assumes the rest of the world or U.S. citizens don’t consume any gold.

Conclusion for Investors

The latest Hong Kong government data show that Hong Kong and Chinese demand for gold is still very strong even after prices have stabilized. Additionally, exports are clearly heading East with Hong Kong registering the largest reported net imports of gold in its reporting history and at this pace all world gold mine production would be imported into Hong Kong.

Additionally, U.S. exports of gold to Hong Kong are double its production, which means that the United States is losing a lot of gold every month. At some point either U.S. gold available for export will be cut and global prices for gold will probably rise, or Hong Kong demand for gold will drop and the gold price will probably drop alongside of it. It’s like a global game of gold chicken.

We believe that at a certain point Eastern gold demand will overwhelm Western available gold – which is what happened with the collapse of the London gold pool in the late 1960s. The players were different but the game was the same, physical gold was used to meet demand and the gold price languished around the set $35 dollar price level as gold was sold from U.S. vaults to satisfy physical demand. But at a certain point those defending the $35 dollar price level decided that they had used enough physical gold and could no longer satisfy physical demand, and that’s when the gold price really started to rise.

So investors need to decide which side they believe will break first, the Eastern gold buyers or the Western gold sellers. We believe that all the signs are pointing to a short supply of physical gold and large increases in the currency base, so investors should take the Eastern side in this game and thus they should consider buying physical gold and the gold ETFs [SPDR Gold Shares (GLD), PHYS]. For investors looking for higher leverage to the gold price, they may want to consider miners such as Goldcorp (GG), Yamana Gold (AUY), Randgold (GOLD), or even some of the explorers and silver miners such as First Majestic (AG).

Hong Kong data is showing that Eastern demand is still very strong for gold. The question investors should ask is will Asian buyers be exhausted first or Western sellers – we think the Asian buyers are clearly showing their desire for gold and investors should take note.