While Chinese gold mine production has increased substantially over the past decade, there is a threat that they may indeed be running out of economic gold mineable reserves in the future. China has increased its gold production from less than 100 metric tonnes twenty years ago to a forecasted 430 mt (metric tons) in 2013.

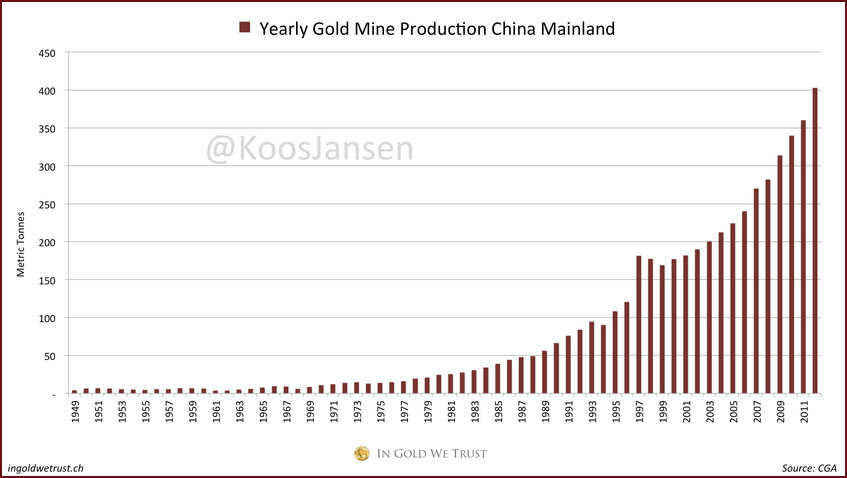

The chart below from the article, “Chinese Gold Mining Exploding”, shows the steady as well as rapid increase of Chinese gold production:

As you can see from the graph, gold mine supply has increased at a much faster pace since 2008 when it was 288 mt compared to the forecasted 430 mt in 2013. This is nearly a 50% increase during this time period (2008-2013) compared to the 44% increase from 2003-2008.

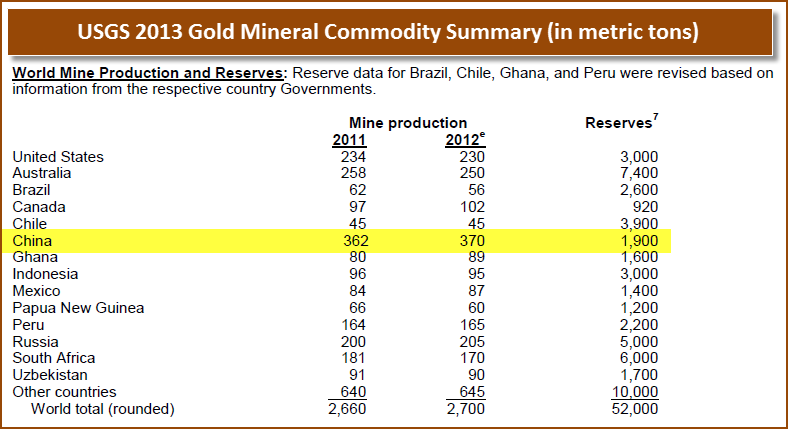

The Chinese are running through their gold mineable reserves faster than the rest of the world. According to the USGS 2013 Gold Commodity Summary, the Chinese had 1,900 metric tons of gold reserves in 2012:

(NOTE: the USGS and GFMS have different estimates of annual gold production)

The Chinese have approximately 5 years of gold mine reserves remaining if we figure 400 mt into 1,900 mt total reserve. There hasn’t been an update on Chinese gold reserves on the USGS website for several years, but we can plainly see that Chinese present gold reserve life is much lower than other countries in the world.

Present Gold Reserve Mine Life Based on Present Annual Production:

China = 5 years

Australia = 30 years

United States = 13 years

Russia = 24 years

South Africa = 35 years

Peru = 13 years

Canada = 9 years

China has half the gold mine life reserves as does Canada, a fifth of Russia’s, a sixth of Australia’s and one-seventh that of South Africa. So, the higher China grows its annual gold production, the quicker they will run through their gold mine reserves.

Jim Rickards stated on an interview a year or so ago, that the Chinese were mining gold as fast as they could to build up their central bank reserves, however at this pace their gold mineable reserves would run out by the end of the decade. I tried to locate that interview and information, but could not.

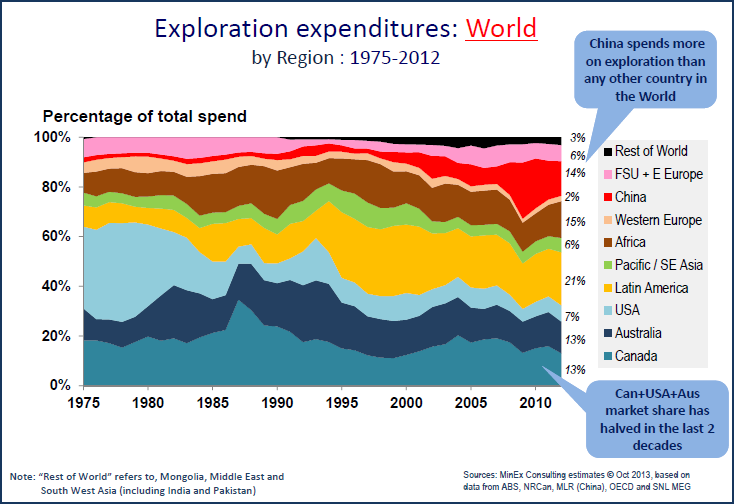

The Chinese spend more on exploration than any other single country in the world. This slide came from a presentation on the Junior Explorers in Canada by Richard Schodde, Managing Director of MinEx Consulting:

China alone spent 14% of the total $30 billion on global exploration in 2012. Schodde goes on to show that Canada spends most of its exploration amount on gold. The presentation did not give a break-down on exploration data on other individual countries, but I would assume China is probably doing the very same thing.

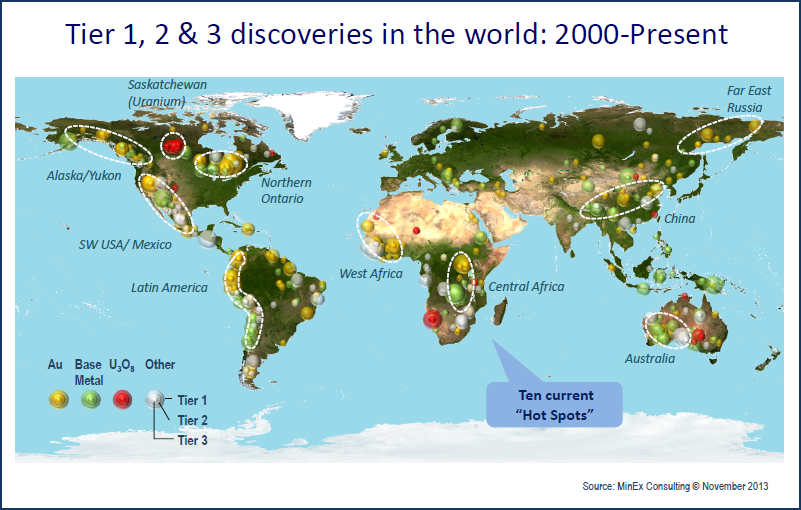

Furthermore, the same presentation provides a graphic showing the top-tier global discoveries since 2000, including gold, base metals and uranium. Here we can see that while China is included as one of the top ten hot spots for discoveries in the world, its gold discoveries are much less in comparison to other countries and regions that have a much lower annual mine supply.

Basically, China is burning through its gold mineable reserves as fast as it can so it will have as much gold in its central bank vaults when the world finally goes back to some sort of gold-backed monetary system.

We may not have the actual data on China’s remaining mineable gold reserves, but it is highly probable that their huge growth in annual gold production may not be something they will be able to continue for much longer. I believe their annual gold production will more than likely peak in the next few years as their reserves and mines become increasingly depleted.

China will probably continue to produce a lot of gold in the following years, but their overall production will likely decline. This is precisely why they are obtaining a great deal of gold properties throughout the world…. there’s nothing like guaranteeing future gold supply by owning gold mines in foreign countries.