Gold fell by 28% in 2013. That’s a huge reversal of a decade-plus trend.

Between 2001 and 2012, gold managed positive gains every single year, a track record unmatched by any major asset.

The precious metal went from a low of $255 in April 2001 to a high of $1,900 in September 2011, for a peak return of 745%.

Since then, gold has given back 35% from its $1,900 high, leading many to call the end of the gold bull market.

But is it really finished?

By looking at history and numerous indicators, I’ve found a different story.

One that will jumpstart your 2014 profits…

Simple Economics Guarantees a Gold Rally

Fundamental drivers for gold are so numerous I hardly know where to start.

Unprecedented quantitative easing (money printing) and ultra-low interest rate policies imposed by central banks – especially in the United States, Japan, Europe and China - are in the news every day.

Here are several others that aren’t grabbing headlines yet, but shouldn’t be ignored.

Shuttering Operations: It’s no secret that falling gold prices have made numerous mines unprofitable. That’s pressured management at those mining companies to rationalize their operations. Producing gold at a loss doesn’t make for happy shareholders.

Shuttering Operations: It’s no secret that falling gold prices have made numerous mines unprofitable. That’s pressured management at those mining companies to rationalize their operations. Producing gold at a loss doesn’t make for happy shareholders.

So mines are being put on care and maintenance,seriously cutting into gold production worldwide. Evy Hambro, who manages BlackRock Inc.’s $8 billion World Mining Fund, said gold supply could fall “quite rapidly” as producers restrict output at higher-cost mines.

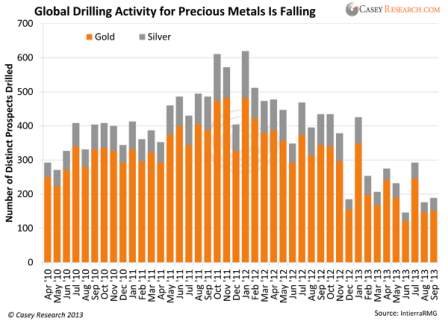

Fewer Discoveries: Lower gold prices have meant, of course, lower profits. So, miners are cutting back on expenses that aren’t immediately accretive, affecting the development of mine expansions, new projects, and exploration. That’s inevitably going to mean fewer ounces available to mine in the near and medium terms than would have been the case without this gold price rout. There were half as many drills looking for precious metals in the first 9 months of 2013 versus 2012.

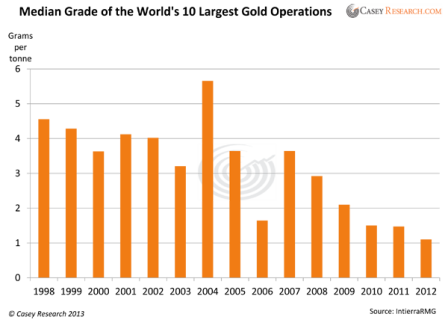

High-Grading: In response to lower prices, gold miners have resorted to mining higher-grade ores while leaving behind low-grade ores. That allows them to be more profitable on ounces produced this way, but it means much higher prices will be needed to go back to the lower-grade ores. In some cases, these may never even be mined out at all.

Physical Asian Buying: Asia loves gold, and that trend continues. In the first nine months of 2013, India and China together had bought 1,500 tonnes (1,653 short tons) of gold, easily dwarfing Western purchases. When Indian, Chinese, and central bank buying are combined, they account for nearly the entire annual world gold production.

Overall, gold fundamentals have not only remained intact, they’ve continued to improve. So it’s easy to project them to push higher gold prices in the future. They’ve got the laws of economics behind them…

Gold Hits the Same Bottom – Twice

An important part of technical analysis involves analyzing price action. And gold’s had plenty of that over the past year.

Most significant was the massive price drop in mid-April when a black swan crash-landed on the gold market.

Over just two trading days, gold futures prices shed 13%, falling from $1,575 to $1,375. That $200 cliff dive was the largest two-day drop in 33 years.

By late June the price had fallen further still, to $1,180 per ounce. So far, that’s been the low.

Recent news of the Fed’s QE tapering again weighed on gold in late December, causing it to momentarily drop to $1,182, then immediately reverse upward by $32.

While it’s still early to say for sure, that may have been a “double bottom” – dropping twice to the same level without moving further down – hit in June then in December. This increases the chances that the $1,180 level is the low for gold prices in this drawn-out consolidation process.