As Wall Street and the financial media carry on business as usual, the underlying foundation of the U.S. economy continues to disintegrate. Very few Americans realize we have past the point of no return. This holds true for many of the precious metals investors.

Even though precious metal investors are more educated and better prepared than the typical American as it pertains to the upcoming economic collapse, I still believe a good percentage fail to grasp that the energy situation is the root cause of our problems.

I would guarantee that most precious metals investors know the price of the metals are up substantially since the beginning of the year, but how many realize the price of natural gas is up twice as much silver and three times as much as gold?

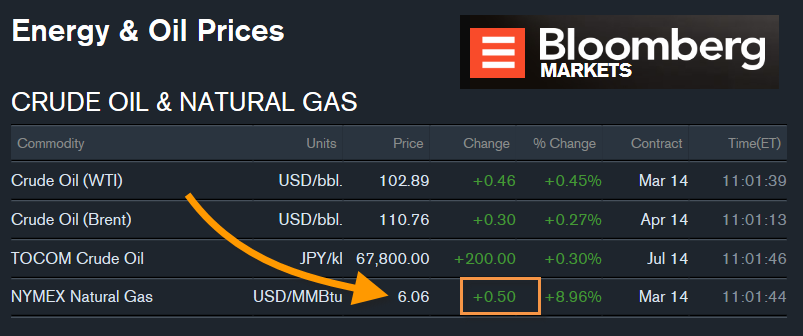

If we take a look at some of the recent metals and energy spot quotes, we can see that while the metal prices are moving up nicely, the price of natural gas is going berserk:

The Kitco metal prices are from today’s trading (Thursday), while the energy spot quotes are from yesterday (Wednesday). The price of natural gas was up another $0.15 at one time today, but is currently trading at $6.04.

So why has the price of natural gas spiked so high and what does it have to do with the precious metals?

Let’s first look at why the price of natural gas has gone up 28% year to date and then I will get into the reason precious metal investors need to pay more attention to the energy markets.

The so-called “Polar Vortex” hitting the Midwest, Northeast and to a lesser extent the South this winter, has caused record withdrawals of underground natural gas supplies.

Here is a graph I posted in my article, Natural Gas & Precious Metals Prices To Spike Higher in 2014 last week:

At the time of the U.S. EIA (Energy Information Agency) Natural Gas Report dated Feb. 13th, gas storage levels in the country were already down 34% compared to the same period last year. I included an estimated trend (blue dashed line) of where the level would fall by the end of March.

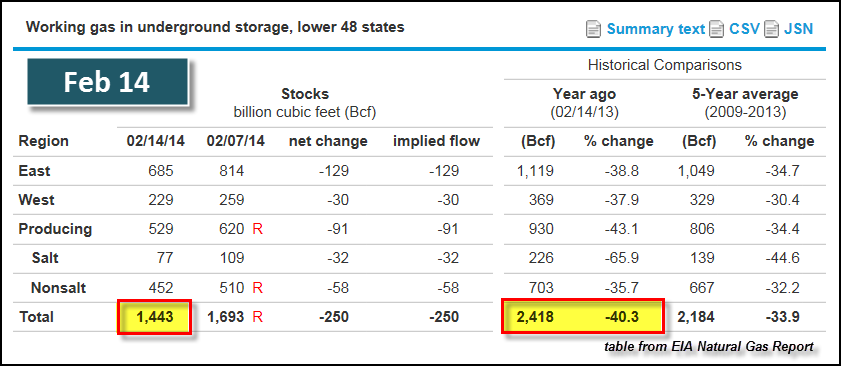

Today, the EIA came out with their latest natural gas storage report and we can see… the trend continues:

(NOTE: Bcf = Billion cubic feet)

In just the past two EIA Natural Gas Reports, reported withdrawals were 237 Bcf (Feb 13th) and 250 Bcf (Feb 20th). Thus, 25% of the total remaining gas supplies were withdrawn in this two-week period. Here are two tables from the EIA detailing the natural gas withdrawals from the two weekly periods:

The dates on these tables represent the last reporting day for that week. The reports are releasing data from the previous week. If the Northeast continues to be plagued by the frigid weather, I estimate that underground gas storage levels could fall to 800-1,000 Bcf.

This is not that unrealistic as there are still 6 weeks remaining (on average) for gas withdrawals.

If the U.S. gas underground storage levels fall this low (or lower) by the end of March, it could push the price of natural gas up even higher… possibly towards the $7-8 level.

Even worse, the shale gas industry will have to rebuild the underground gas storage from an extremely low-level. There is speculation by some energy analysts that the U.S. could peak in natural gas production this year.

If this is the case, it could spell disaster for next winter as the U.S. could head into the cold season with a much lower underground gas supply. Not only would the market have less gas going into the winter season, we may see natural gas price spikes double of where they are today.

Last year, most energy analysts and institutions were forecasting significantly lower prices than what the market is trading presently. The EIA made this forecast last summer published inEnergyWire:

Shale gas production doesn’t make a major upward move until 2016, according to EIA.Spot prices for natural gas at the major Louisiana pricing hub will drop to $3.12 per million British thermal units in 2014 and 2015, below this year’s average forecast price of $3.25, according to EIA’s Annual Energy Outlook. Prices don’t pick up until 2016 either, in the EIA assessment.

The EIA forecasted a price for natural gas almost $3 less than where it is today. While the weather is a major factor pushing the price of natural gas to a new highs…. energy analyst, Bill Powers believes we would have seen much higher prices ($5-$7) by 2015 even if weather wasn’t an issue.

This is due to what Powers forecasts as the “Bursting of the U.S. Shale Gas Bubble.” Bill also believes the high annual shale gas decline rates will become increasingly difficult to offset with new production.

According to a Citi Report last year, they estimated the annual decline rate for the U.S. natural gas industry is about 24%. Thus, the shale gas industry has to replace nearly 100% of all production within the next four years, just to keep production flat… much less growing.

So what does natural gas have to do with the precious metals?….a great deal as you will find out.

There is this notion that the U.S. will become energy independent within the next several decades. This gives the public and investors the illusion that economic growth will continue for quite some time. If domestic shale gas and oil production peaks and declines much sooner (possibly in the next 1-2 years) than the market anticipated… it could cause serious trouble for the Stock & Bond Markets.

People need to realize that the supposed “American Dream”, I label as the LEECH & SPEND SUBURBAN ECONOMY, cannot survive without a growing energy supply.

Once the world realizes that Shale Energy will not allow business as usual to continue, valuations of Stocks, Bonds and most paper assets GO OUT THE FRICKEN WINDOW.

That is why it is so damn frustrating to see my energy articles receive 20-30% of the typical readership compared to a precious metal article. Do gold and silver investors still not realize that ENERGY IS THE KEY??? The guy in the cartoon below does:

I believe things will begin to fall apart in the U.S. once we experience a peak in shale oil or gas production. This will cause a profound shock to the Stock, Bond and Paper markets.

Precious metals will be some of the best and safest assets to own during this “Energy Induced Collapse.”