Here’s another neat info-graphic from the folks at

Demon-ocracy, this one depicting a variety of mostly silver (with some gold) bars, balls, and blocks of bars from which the image below was culled.

read more

While producing my recent works, Sell Gold and Silver Further on this Jobs Report and Annaly is the Big Beneficiary of Focused Mutual Fund Flows, I made an important connection. By now most investors are aware of the capital flow fuel being provided to stocks at the cost of precious metals and money market funds. Well, within those broad reaching trends, there are cross currents and side stream...

read more

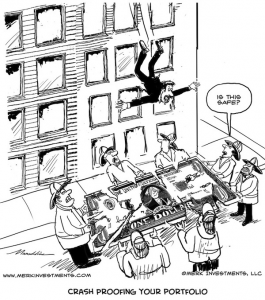

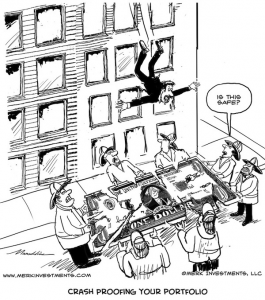

Peter: A lot of talk about a dollar crash keeps coming up in the blogosphere. Is it a serious threat, and if so, what should an investor do about it?

read more

There's been a lot of verbiage spilled over the situation in the price of gold (GLD). This is a difficult situation to handicap because of the sheer importance of this period in time. The Federal Reserve has been trying to talk down the inflation it is inviting through expansion of the monetary base by trying to make us believe that it would end its Quantitative Easing program within a few mont...

read more

People are going to see moves in gold that will shock them. Some of the advances will be spectacular, but right now people are focused on short-term weakness so they are missing the big picture. - John Embry, King World News

The U.S. media is oozing with bearish reports offering up every reason imaginable as to why the bull market for gold is finished and why gold is entering a bear...

read more

read more

read more

read more

read more

read more

read more