Jim Rogers decries the growing uncertainty and recklessness of global central planners as the world enters unchartered financial markets:

For the first time in recorded history, we have nearly every central bank printing money and trying to debase their currency. This has never happened before. How it’s going to work out, I don't know. It just depends on which one goes down the most an... read more

Jim Willie, who holds a PhD in statistics, says, “There are staggering bullish market indications for gold. The primary cylinder is negative real interest rates for the past 10 years.” Dr. Willie says other bullish factors include “phony accounting at insolvent global banks” being propped up by massive money printing. Dr. Willie contends, “In January alone, the European banks wer... read more

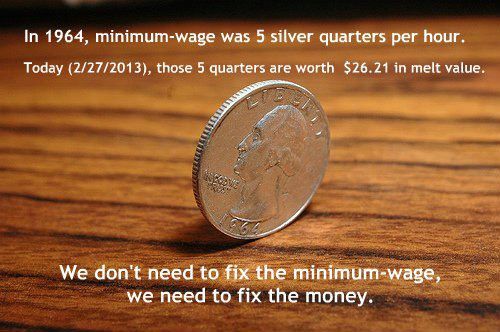

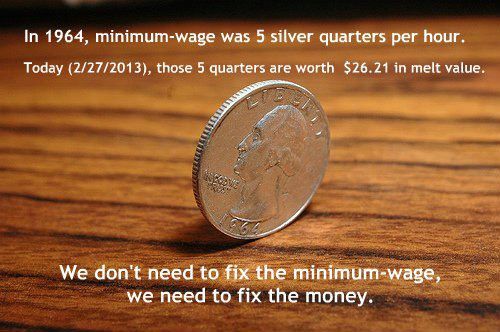

I forget where I came across this, but it seemed worth sharing rather than just discarding it since there’s been lots of talk about raising the minimum wage lately, but far too little talk about the value of money.

read more

read more

read more

read more

“Depend upon it, Sir, when a man knows he is to be hanged in a fortnight, it concentrates his mind wonderfully.”

-Samuel Johnson

The world today does not smell of lavender and lilacs these days but more like old grease that has gone rancid. Always a skeptic, I find myself these days looking with more of a jaundiced eye than usual as I stare ou... read more

You won’t hear about it in the usual places. Everywhere you turn these days, all you hear is that gold is down, it’s finished, it’s heading for something called a “death cross,” which sounds terrifying. But away from the headlines, gold just rocketed to a new, all-time high.

Where? In Japan — the world’s fourth largest economy.

The arrival of a new government in December, an... read more

Gold

Despite the exodus from gold and into equities, golds decline hasnt been nearly as precipitous as that of the gold/silver mining stocks. Nor has gold suffered to the degree one would expect given the inflows into equities and mutual funds. Take the 1-year chart for the SPDR Gold Trust ETF (GLD) for instance. Although the Dow Jones Industrial Average (DJIA) made a new all-time hig... read more

The Fed is creating Trillions of “new money” while central bank bullion buying is at a 48 year high. The Fed is printing money and driving up consumer prices for Americans, while China, Russia, and many countries are buying gold.

It would appear those other countries trust and value gold more than they trust the dollar – especially when it is being spent, borrowed, and printed in exce... read more

Even though the newsletter I write for Casey Research is focused primarily on gold, our metals investments cover all the precious metals, and when warranted, some base-metals plays too. And with the markets in the state they are, I want to say something about silver..

My talk at the Vancouver Resource Investment Conference in January was titled Is D-Day for Silver Approaching?, and highlight... read more

Despite what the media and politicians would have us believe, the United States did not collapse last Friday when the package of spending reductions known as "sequestration" went into effect. The financial markets hardly blinked, as they have come to be more skeptical about these periodic government-hyped "crises."

What had been portrayed as a drastic reduction in government spending was mer... read more

One of my best friends recently discovered, to his shock and dismay, that five one-ounce gold coins had been stolen from his home. I feel especially bad because I had encouraged him to buy some physical metal, giving him some tips and pointing him to the better dealers.

What’s especially disconcerting about the theft is that my friend had the coins stored in a safe, hidden from view,... read more